Music hi and welcome to another IRS forms video today we're tackling IRS form 1 to 277 application for withdrawal of federal tax lien. Getting the IRS to withdraw lien can be a huge benefit for your clients, so let's take a look at what that takes and how you can use form 1 to 277 to make it happen. Tip number 1: How to resolve IRS liens and when to use form 1 2 to 7 7. When a taxpayer lets their tax debt go unaddressed for too long, the IRS will respond by placing lien on their assets by issuing a lien. The IRS is asserting a legal claim to the taxpayers' property as the security against the tax debt that claim if left unchecked will end with the IRS seizing the taxpayers assets. Tip number 2: Reasons for lien withdrawal. Getting a lien with John is obviously the preferable option, so how do you know if your client qualifies to have their lien withdrawn? Line 11 of form 1 2 to 7 7 lists for reasons the IRS will consider withdrawing the lien. Reason number 1 is the notice of federal tax lien was filed prematurely or not in accordance with IRS procedures. The IRS will withdraw the lien if the tax that eventually prompted the was assessed in air or if the lien was filed without giving the taxpayer proper notice. This is extremely rare as the IRS has multiple fail safes in place to avoid these kinds of mistakes, but mistakes do still happen. The IRS will withdraw the lien if you can prove it. Reason number 2 is the taxpayer entered into an installment agreement to satisfy the liability for which the lien was imposed and the agreement did not prior a notice of federal tax lien to be...

PDF editing your way

Complete or edit your irs form 12277 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export form 12277 directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your irs lien release form as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your irs tax lien release form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form 12277

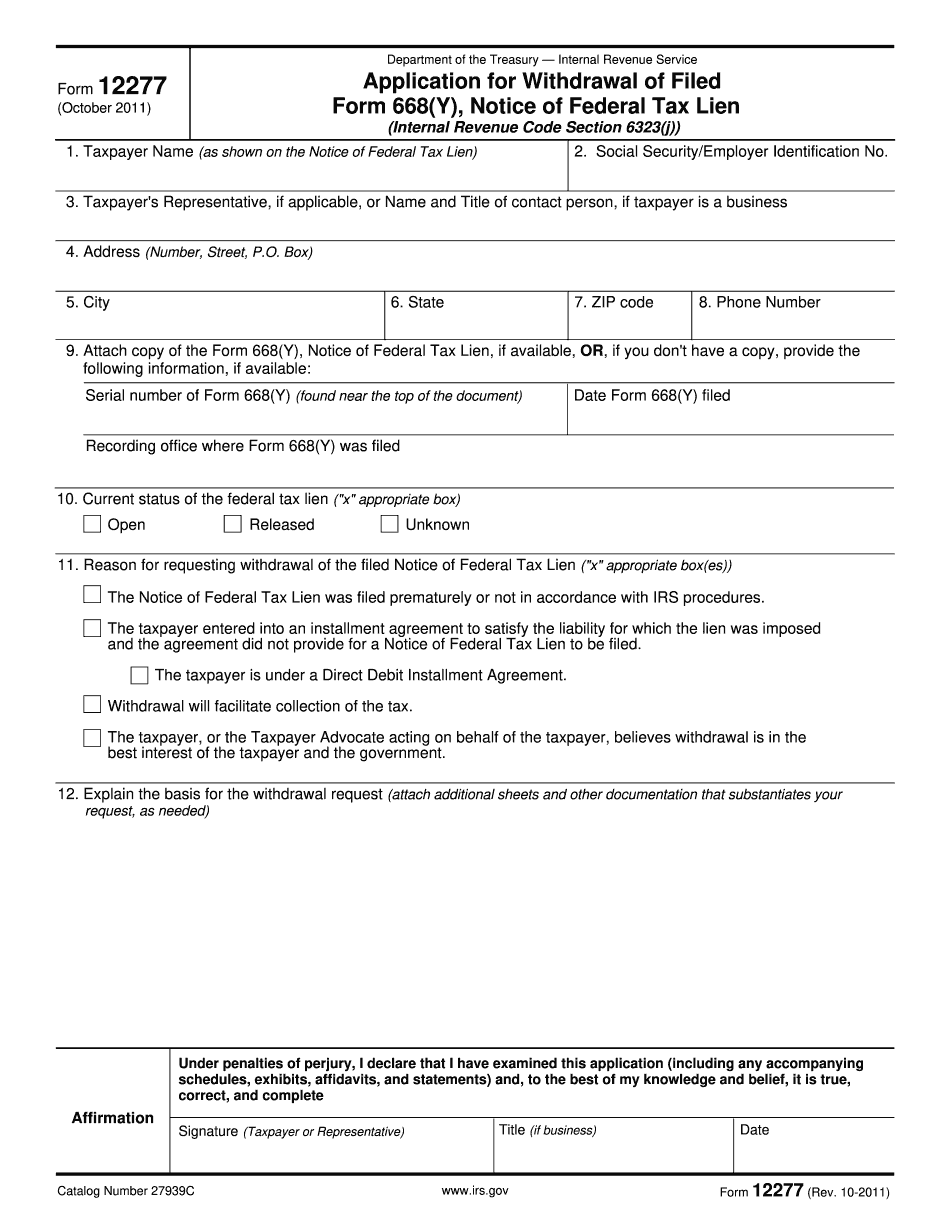

About Form 12277

Form 12277 is an Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien. This form is needed by taxpayers who have paid off their federal tax lien or have negotiated a payment plan with the IRS and want to have the lien removed from their credit report. The purpose of this form is to request the withdrawal of the notice of federal tax lien from public records and release the taxpayer's property from the lien's claim. The form requires the taxpayer to provide identifying information and specifies the reasons for the withdrawal request, such as payment in full or the determination of an improper filing of the lien.

What Is tax Form 12277?

Online technologies assist you to organize your file management and boost the productivity of the workflow. Observe the short information in an effort to fill out IRS tax Form 12277, avoid errors and furnish it in a timely manner:

How to fill out a Irs Form 12277?

-

On the website with the form, click Start Now and pass for the editor.

-

Use the clues to fill out the suitable fields.

-

Include your personal information and contact data.

-

Make certain you enter correct data and numbers in proper fields.

-

Carefully review the information of the form as well as grammar and spelling.

-

Refer to Help section if you have any concerns or address our Support staff.

-

Put an electronic signature on your tax Form 12277 printable with the assistance of Sign Tool.

-

Once blank is completed, press Done.

-

Distribute the prepared document through electronic mail or fax, print it out or save on your device.

PDF editor lets you to make modifications on your tax Form 12277 Fill Online from any internet connected device, personalize it according to your requirements, sign it electronically and distribute in different means.

What people say about us

E-filing templates from your home - crucial recommendations

Video instructions and help with filling out and completing Form 12277