Oh no, you have a property and it has a lien on it. Maybe the property you purchased is a foreclosure investing property. It's easy for a lien to get on a property. So, how do you get a lien off of a property? Here are ten possible ways to remove liens from property: 1. The first and most direct method is to record a release of lien. This requires the lien holder or their representative to authorize the release. The release document must be recorded, although the original lien document will still remain in the land records. The separate release recording will match up with the original lien and effectively remove it from the title. 2. There may be an opportunity for statutory tolling of the lien. This means that after a certain period of time, according to the statute of limitations, the lien will be effectively removed from the property. It's important to check the type of lien and the applicable statute in that jurisdiction. 3. Another method is to negotiate other collateral. If there's a lien on one property and you need to sell, mortgage, or get financing for it, you can try to shift the lien to other collateral. This could be another piece of property, a bank account, a vehicle, or a promissory note. This way, you can remove the lien or the debt from the property and transfer it onto something else. 4. In a worst-case scenario, you can pursue a quiet title action. This involves filing a court case to have the lien removed from the property. If the lien holder does not oppose the action, the court may grant the request. 5. A stop letter can also be sent by the lien holder. This letter identifies the amount of the lien and provides instructions on how...

Award-winning PDF software

What happens when the irs puts a lien on your house Form: What You Should Know

It is in this way that the lien secures our interest in your tax bills and balances. Your credit history records such liens that can help you in the process of resolving them and avoid a foreclosure or bankruptcy. Your credit history record can include: the number of property liens, any lien amount, the name of the creditor, the date of the lien, the purpose of the lien, the nature of your tax debts, and the time after which the lien will be discharged. You can use a credit history record on your credit report to determine how your credit report might affect your ability to obtain a commercial loan, obtain a mortgage, take out a vehicle or other credit product under a credit history that shows outstanding tax liens. Credit Report The credit information on your credit report is a record of your credit experiences. The information you provide on your credit report has a lot to do with whom you can get credit from and for what amount. In most cases, you should only consider your credit record if you want to know if you could be approved for a credit product. A credit history record and credit report have an important role to play for you in the context of the housing finance law. A credit report records any new credit accounts you have, the interest rates on them, and the terms of the credit transactions. Credit reports are used by the lenders and for the purposes of evaluating the credit worthiness of applicants, including mortgage lenders under Section 106(c) of the Truth in Lending Act. Faulty Credit Reporting Credit files can fail to cover all the credit information required by all the lending institutions when determining the credit worthiness of a person. As reported on the credit file, the credit information may be missing, inaccurate, inaccurate with respect to specific information, fuzzy, incomplete, missing or misaligned. Faulty reporting and improper credit ratings can result in you getting denied credit cards, mortgage loans, car loans, line of credit, or other related products. This can hurt your ability to get a mortgage, obtain credit, or make it difficult for you to finance a car purchase. A credit history for a person cannot establish the credit worthiness of a person with credit problems. How to Remove a Credit Report Filing Error | Credit.

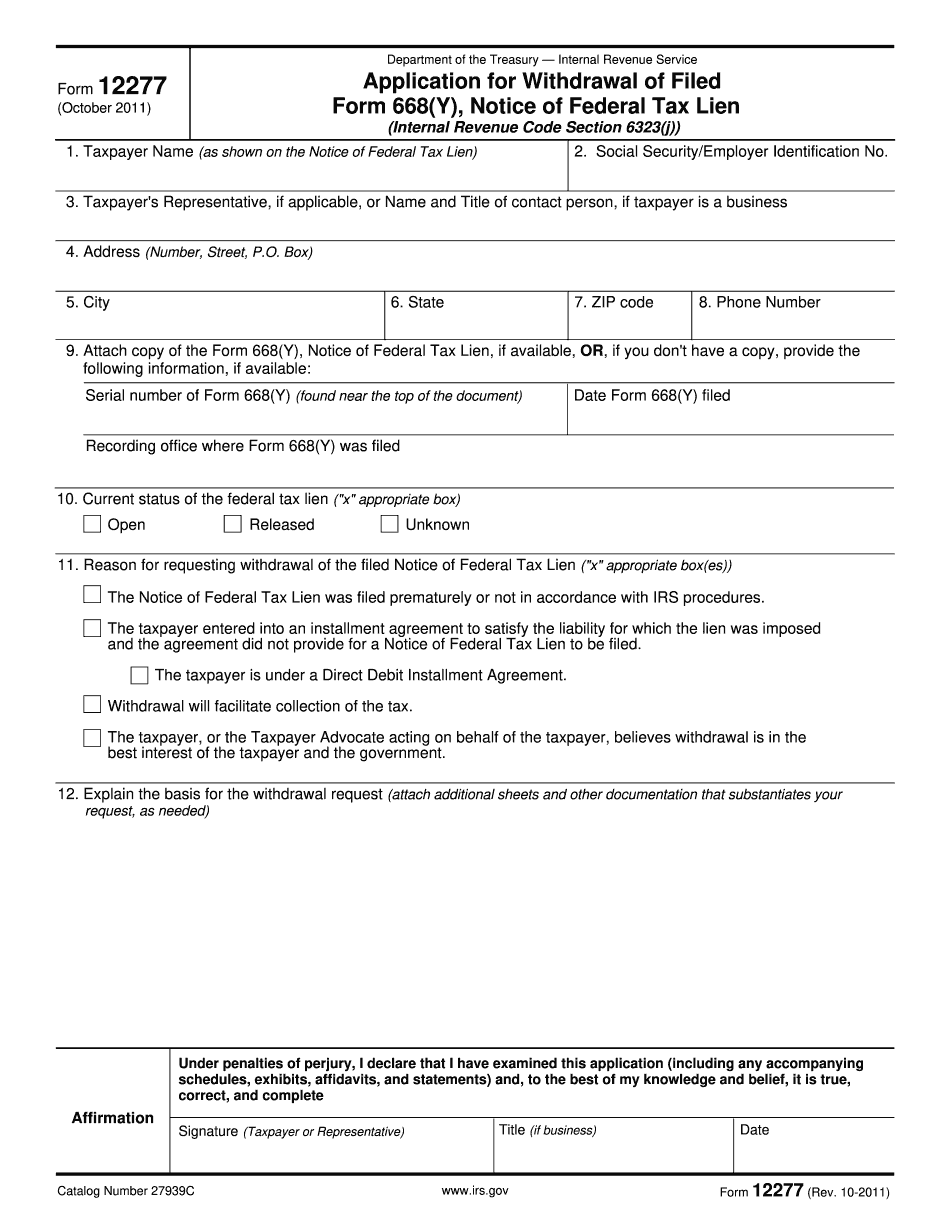

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 12277, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 12277 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 12277 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 12277 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing What happens when the irs puts a lien on your house