Hi, I'm Ron with Tax Court. Now let's discuss the Fresh Start Initiative. First, Start Misha t'v is a program that was started by the IRS a few years ago during the financial crisis to help taxpayers out of their financial burdens with the Internal Revenue Service. Now it's not approval in the right way to tax. What it is, is giving the taxpayer a fresh start and repairing their credit and repairing their grease stain with the Internal Revenue Service to get them out of the bottom at their end. So basically, the First Start Initiative is not a brand new program that's collecting taxes. What it is, is a relaxing of the current regulations that are currently on the books. There are federal tax liens that it helps you with, there are installment agreements that it helps out with, and there's an offering compromised program that it helps up with. Go back and watch some of our videos that talk about each of those specific programs and enforcement actions that the harvest takes and collecting those pass-through tax returns and tax adoption. So first, let's talk about the notice of federal tax lien. Basically, the high risk will always follow a tax lien or any amount above ten thousand to her at $10,000 award. However, the IRS will always follow a tax lien when it feels like its interests are being threatened. So they can file a tax lien when the amount is below $10,000 if they feel like it's necessary. What the Fresh Start Initiative does is it allows a taxpayer to have a notice of federal tax lien withdrawn from the public record, meaning it comes out of the public record at the county courthouse and the county that you reside. It also can come off of...

Award-winning PDF software

Irs fresh start program Form: What You Should Know

Who Qualifies to Use the IRS Fresh Start Program? The IRS Fresh Start Program can be a great way for taxpayers whose tax debt is less than 25,000 to reduce their tax liability and avoid tax levies or taxes. The program is available to individuals and small businesses with income tax owed for FY 2025 through FY 2016. The IRS is also able to reach into the Federal Reserve and offer its assistance by making a cash offer to taxpayers. The program is designed to help taxpayers who have had problems paying their taxes pay them off or reduce the total amount owed. The IRS offers the cash offer to individuals and small businesses who are: Taxpayers who would otherwise qualify for a reduction of tax due under other provisions of the Code in combination with a full installment payment or other types of relief. Taxpayers with the IRS' request for reduction of tax due (i.e., the taxpayer is requesting a reduction of tax attributable to income the taxpayer should be able to receive under the rules of the Code when paid in full. Taxpayers who want to resolve their tax debt in a matter other than settlement. The IRS does not intend for this program to be used to settle or close tax liens. The IRS is authorized to offer a cash offer for a tax debt to avoid payment of a tax lien. What Types of Taxpayers Can Apply for the IRS Fresh Start? The IRS offers the IRS to accept as applicants: Individuals Corporations Trusts and estates (including estates of the decedent) Small businesses What Qualifications Do Individuals Must Meet? Under the IRS regulations, individuals have to meet all the following conditions: They have to file Form 1040, Form 1040A (with extension), Schedule A, Part I (payroll withholding), and Schedule E, Part I (Form W-2C) to receive a tax benefit (cash offer to reduce tax). Who Must Complete the Form? All individuals must complete the IRS Fresh Start Form. Anyone can use the Form 1040 and Schedule A, Part III. The form must be signed by the taxpayer whose tax problems would benefit from the offer in compromise. Is the Offer in Compromise Worth the Time and Effort? The offer to resolve one's tax debt in this program usually takes about 15 hours to resolve. This is a small price to pay for a tax holiday.

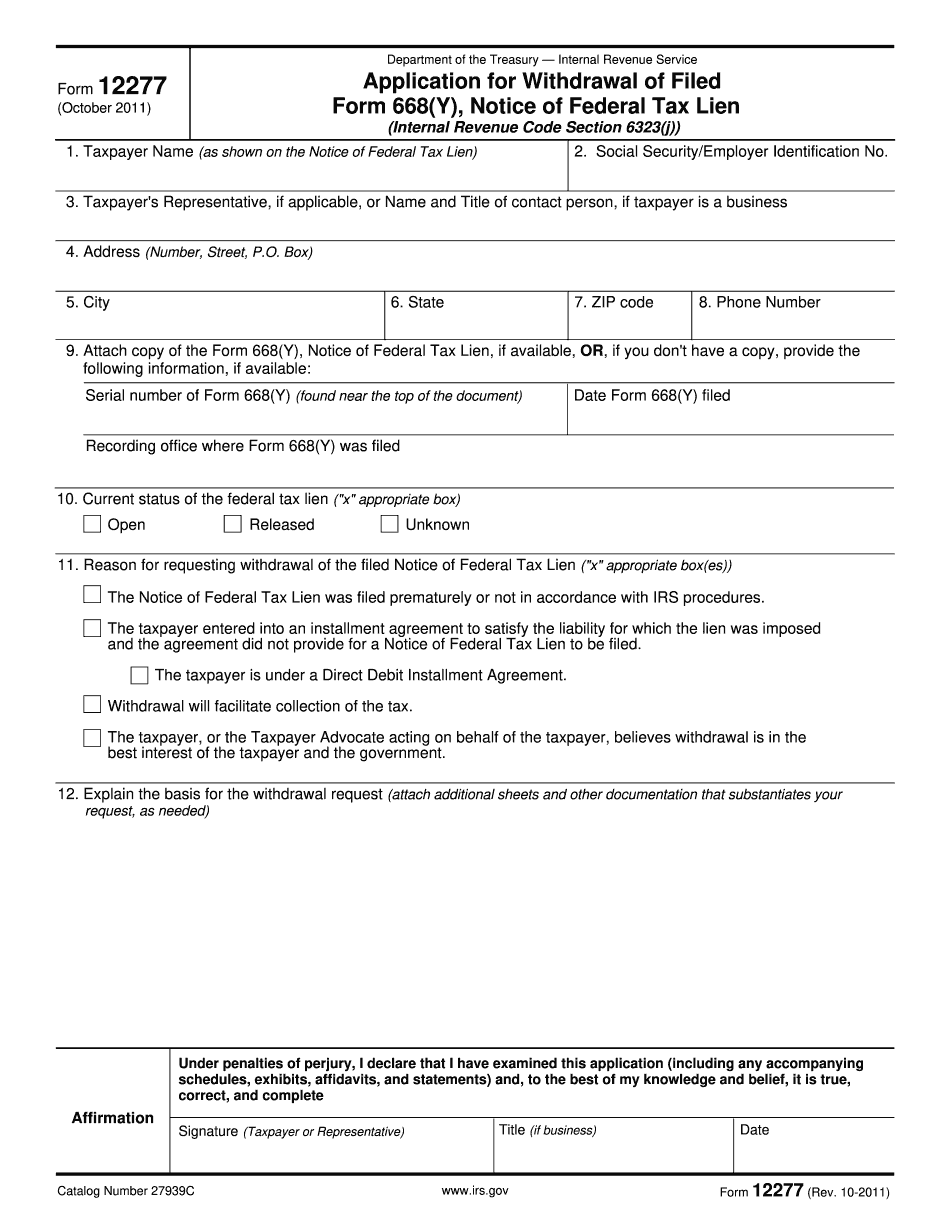

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 12277, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 12277 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 12277 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 12277 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs fresh start program