It's that time of year again. Are you filing your taxes for the first time as a self-employed individual? Oh my god, I need help. In today's video, I will share with you how to file your taxes as a small business owner in Canada. So, if you want a better understanding of your income tax and which deductions and credits you can claim, make sure you watch this video till the end. Disclaimer: I am not a financial advisor or tax professional. This video is not tax advice, it's for general information and entertainment purposes only. You should consult your own tax advisor before engaging in any transactions. If your business runs as a corporation (T2 return), this video is not for you. This video will only cover the form T2125 for filing a T1 tax return as a sole proprietor. Even if you don't plan to do your own taxes or haven't started your business yet, this video will still be useful because you will learn about the deductions you can claim and other important information about starting and running your own business. So, the software we're going to use today is Wealthsimple Tax, formally named Simple Tax. Wealthsimple Tax is an easy-to-use software to file any T1 return, even as a small business owner. And the best part about it, it's free! Although you can pay what you want to help support the platform. Now, before we get into this free exciting tax video, can I get you to hit the like button before you leave? Then hit the subscribe button and the bell icon. Doing so won't cost you anything but really help support my channel. Okay, make your way to wealthsimple.com. If you already have a Wealthsimple Invest, Cash, Trade, or Crypto account, you can use the same login info...

Award-winning PDF software

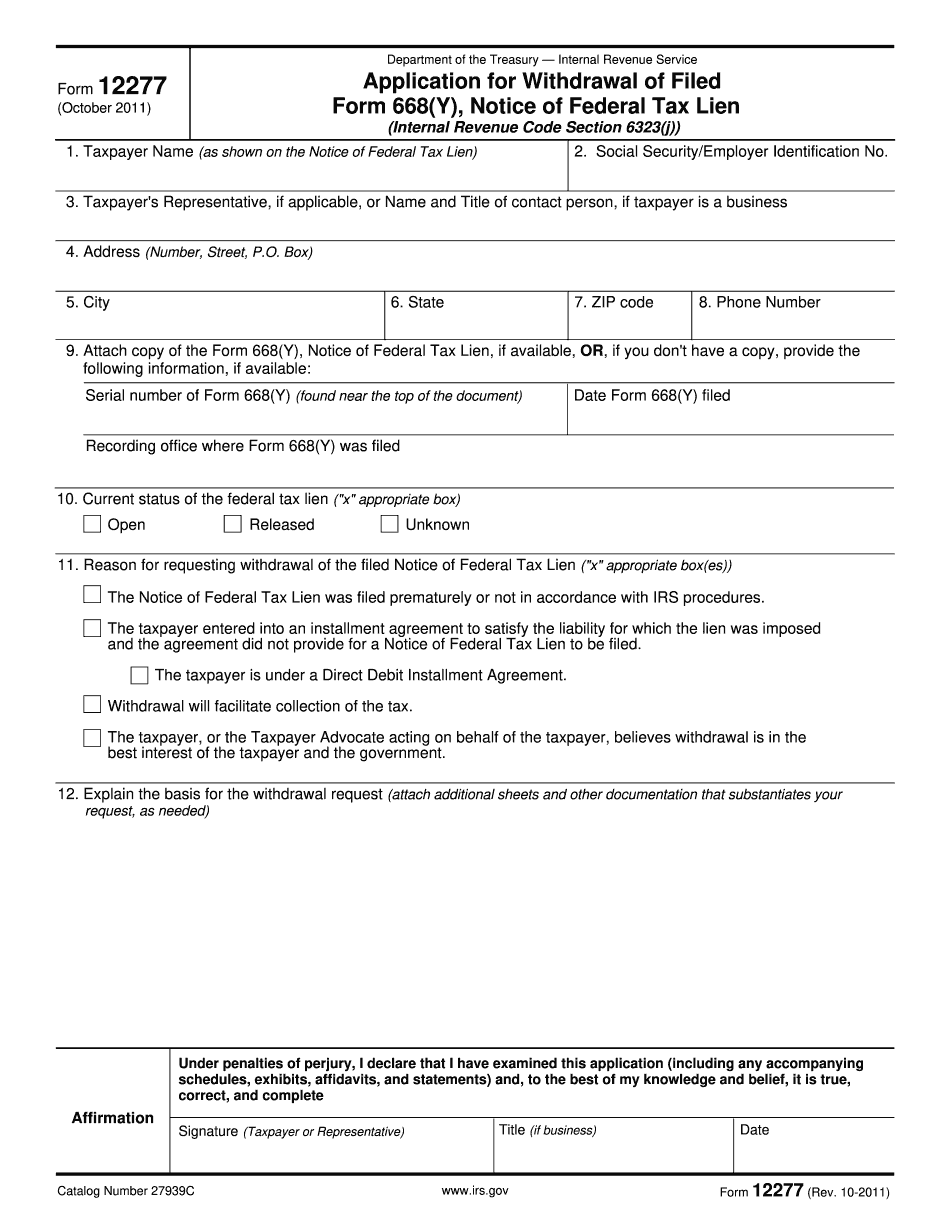

Irs Levy On A Self-Employed Person Or Independent Contractor: What You Should Know

The income earned while an employee of an Individual with a Disability, Veteran or Active Duty Member of the Armed Forces IRS Levy: Independent Contractors — Wiz tax Sep 10, 2025 — A wage, salary, or similar income that is subject to a 1099-MISC “self-employment” levy. It is one-time payment to you upon your self-employment IRS Levy: Independent Contractors — Wiz tax Sep 11, 2025 — IRS levy is part of your income tax. (Note: the wage, income, and interest that is subject to a Wage or Salary Levy can be reported as wages, salary, or capital gain on your 1040 and/or IRS forms IRS Levy: Independent Contractors — Wiz tax Feb 20, 2025 — Individual with a disability, veteran or active duty member or active duty Reserve component. The wage income is subject to an IRS levy. Payments or commissions are taxable income. May 2, 2025 — Taxpayers are not allowed to do business as an “individual with a disability” without first being approved by a Department of Health and Human Services (DO HHS), unless an HHS waiver to exempt the service member is in effect. The waiver is for one year. Aug 11, 2031 — Payroll tax is now called Social Security and Medicare tax. Sep 6, 2034 — The income and employment status of anyone with a health insurance plan that was first purchased outside the United States must include information on the health insurance plan by the date of the plan's renewal. Mar 1, 2037 — You may not be considered self-employed after March 1 if you have been paid on a contractual basis for at least 25 months in the two years prior to your filing date. You may be considered an individual with a disability if you are unable to perform work because of your physical or mental disability. However, you may not have a disability and be considered self-employed. Mar 1, 2031 — Individuals are considered self-employed if they made an investment of at least 150,000 in the last two years. A self-employed investor must maintain a minimum of 10 accounts and report the income from each account. It may be a loss in one (1) of these accounts that results in the amount that the individual is required to report.

Online options help you to to arrange your document management and boost the productivity within your workflow. Adhere to the quick tutorial so as to total IRS Levy on a Self-Employed Person or Independent Contractor, refrain from faults and furnish it inside a well timed way:

How to complete a IRS Levy on a Self-Employed Person or Independent Contractor on the net:

- On the web site with all the kind, simply click Start off Now and pass to the editor.

- Use the clues to fill out the suitable fields.

- Include your personal data and call knowledge.

- Make convinced you enter appropriate info and numbers in proper fields.

- Carefully check out the articles of the type at the same time as grammar and spelling.

- Refer to help you area when you've got any doubts or handle our Support staff.

- Put an digital signature on the IRS Levy on a Self-Employed Person or Independent Contractor with all the support of Signal Tool.

- Once the form is accomplished, push Completed.

- Distribute the prepared form by using electronic mail or fax, print it out or help save in your equipment.

PDF editor allows for you to make alterations in your IRS Levy on a Self-Employed Person or Independent Contractor from any world-wide-web related gadget, customise it as per your preferences, sign it electronically and distribute in various means.

Video instructions and help with filling out and completing Irs Levy On A Self-Employed Person Or Independent Contractor