Award-winning PDF software

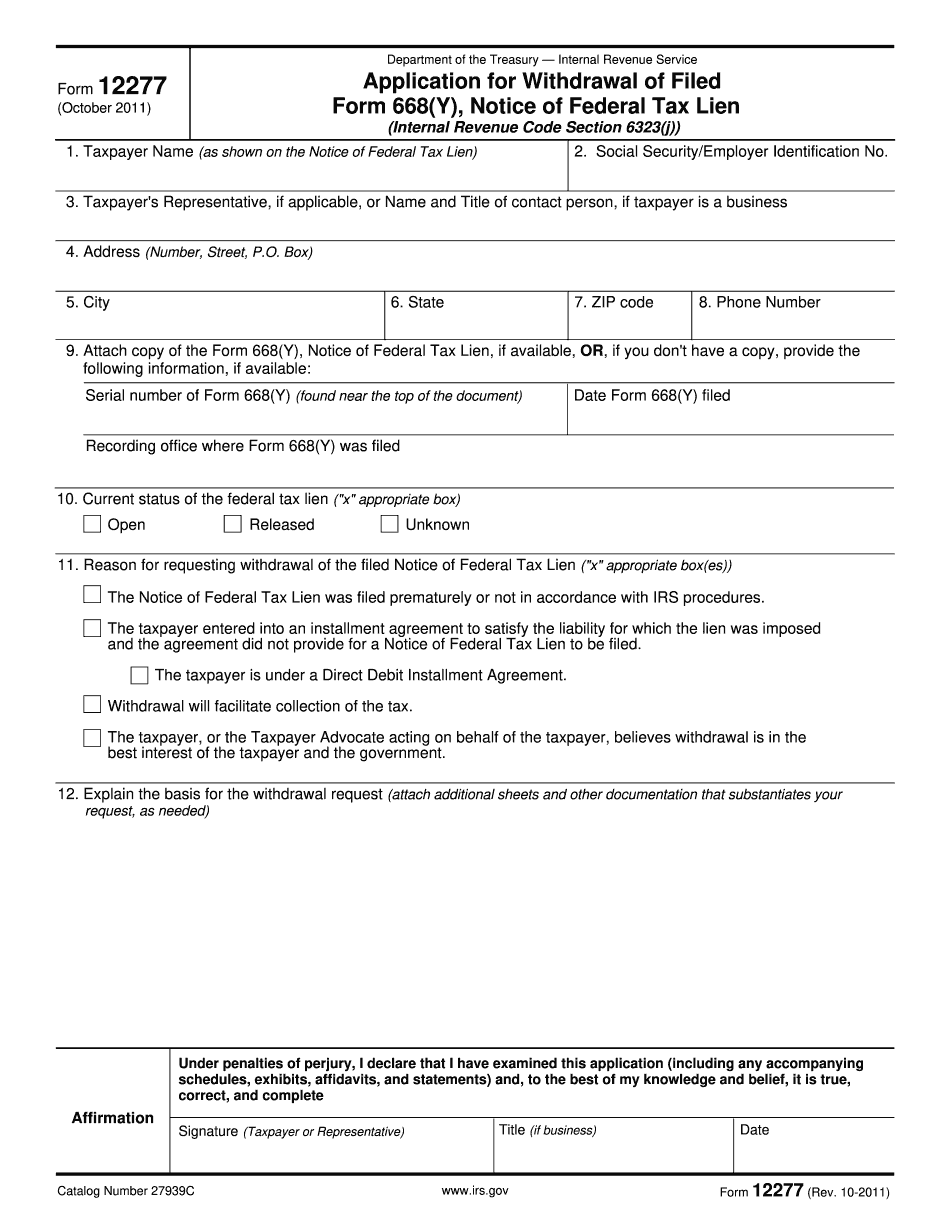

Form 12277 Arlington Texas: What You Should Know

This is because, if you have an IRS Tax Lien, your credit score will be downgraded. In addition, if you've filed for bankruptcy, a Tax Lien can result in having part or your entire loan discharged. You may be able to get a fresh start with a Tax Lien simply by filing for a voluntary discharge of a Tax Lien and making other required filing, such as the Affidavit for Independent Tax Counselor (ITC). Federal Tax Lien — What is a Federal Tax Lien? A federal tax lien is a mortgage, lien, or charge against residential or commercial property. The law that created this liability was the Real Estate Settlement Procedures Act (RESP), which went into effect on July 17, 1990: § 830. Application for Withdrawal of Filed Federal Tax Lien. The filing of a complaint in the district court against a debtor which is timely filed with the Attorney General of the United States to withdraw a lien under this article shall constitute prima facie proof, in accordance with the requirements of this title, of the existence of a federal tax lien on the property and the failure to file such complaint, if the complaint is timely filed, of the non-filing of such complaint, if the complaint is filed after the expiration of the period prescribed by law for the filing of such complaint. § 830(b) (844). While there are many who may mistakenly believe that Federal Tax Lien are a way of collecting money, or of securing a property when it should be sold, this is not true because: The law gives the Federal Government authority to levy liens and to cancel, modify or discharge a tax lien. “The statute authorizes the Government to levy liens and to cancel, modify, or discharge a federal tax lien. A claim to relief under this section or an application for relief under the statute is considered to bear a prima facie, on its face, relation to a federal tax lien.” In other words, the law gives law enforcement authority to collect money, as opposed to obtaining property from its owner. The IRS has authority to cancel or modify liens. However, the IRS has an exemption from the Federal Tax lien laws on all taxpayers who do not owe federal taxes. So, the IRS does not have the authority to collect a tax debt on any property not owned by an individual.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 12277 Arlington Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 12277 Arlington Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 12277 Arlington Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 12277 Arlington Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.