Award-winning PDF software

Form 12277 for St. Petersburg Florida: What You Should Know

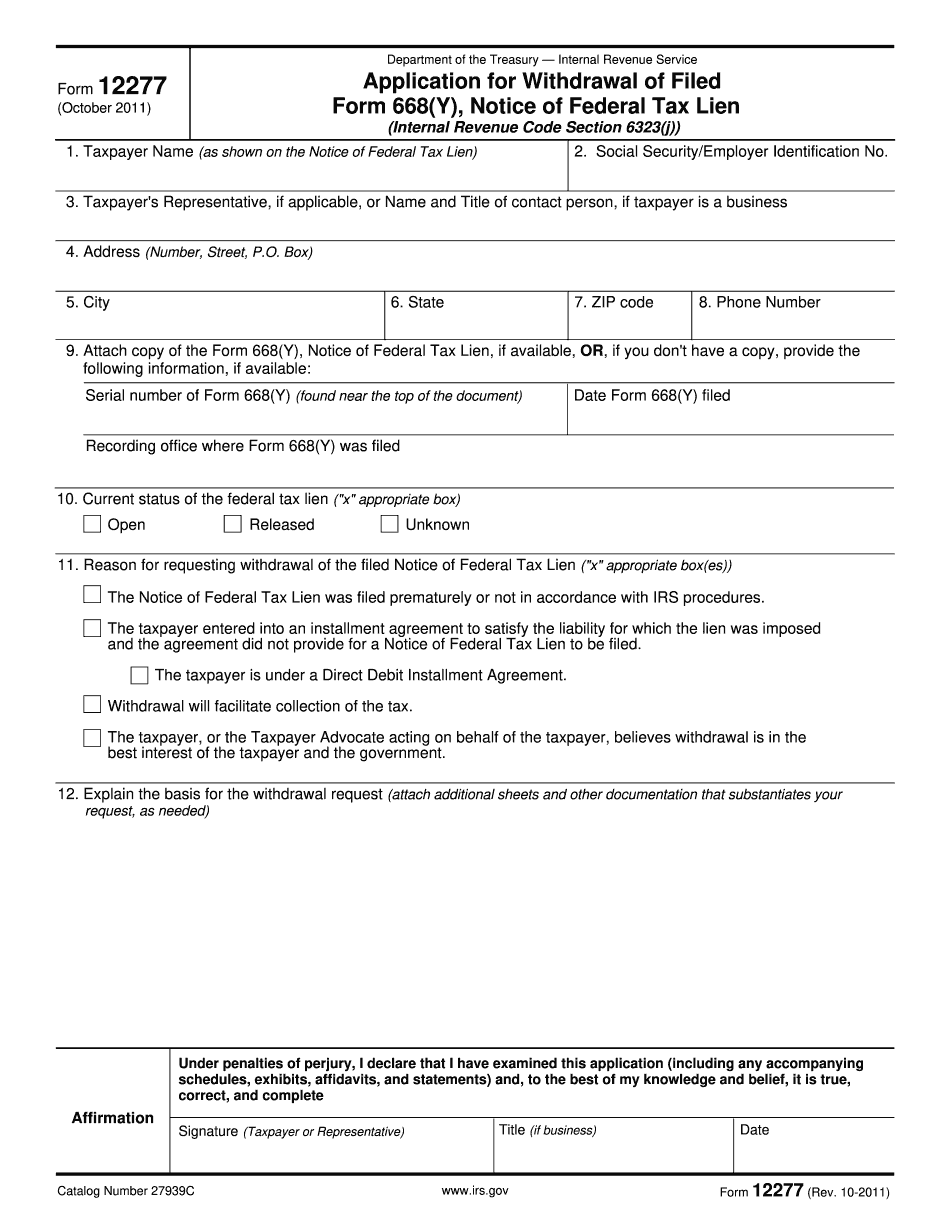

If so, you're right! The “Form 12277” in question is the IRS form for you to withdraw, or remove, the federal tax lien it filed against your property. The tax lien it filed against your property is what caused your delinquent tax situation to begin with. If you're in good standing, the IRS will be unable to go after you with its federal tax lien again, which means it's no longer a factor in your credit history. However, if you've gotten a significant amount of tax owed, you might still want the extra paper you have sitting around on any number of accounts. With this in mind, you may want to withdraw your tax lien as soon as you feel comfortable about your situation and have a legitimate reason for doing so. You should consider withdrawing it with a document that confirms to the IRS that the lien belongs to you because you're not allowed to withdraw tax liens after filing a Form 4868. Here's why: Before After The IRS has no way to verify whether the taxpayer has any other income to cover what it has already declared. This means the taxpayer will have to file new and separate tax returns, which is a waste of taxpayer time and resources. The IRS does have some information about you that is available to it through your tax return, so using this form to withdraw a tax lien is a way to give the IRS more information about you, your income, and your tax obligations. If you are unsure about how to properly withdraw a Federal tax lien, see IRS Forms and Publications, and consult with a tax professional. Once you have completed the registration of the tax lien, you will receive a return of the tax liens. From that, you will be able to download and use a Tax File Number (TEN) or other identification number from the IRS to file individual federal income tax returns using the tax return. Important Tax Facts to understand: Form 12283 The Internal Revenue Code (IRC) requires each taxpayer to file Form 1040, and each payee to file Form 1040A. The Form 1040 is a statute tax return. It shows where you have filed your tax returns, and where you've filed extensions of time to file.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 12277 for St. Petersburg Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form 12277 for St. Petersburg Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 12277 for St. Petersburg Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 12277 for St. Petersburg Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.