Award-winning PDF software

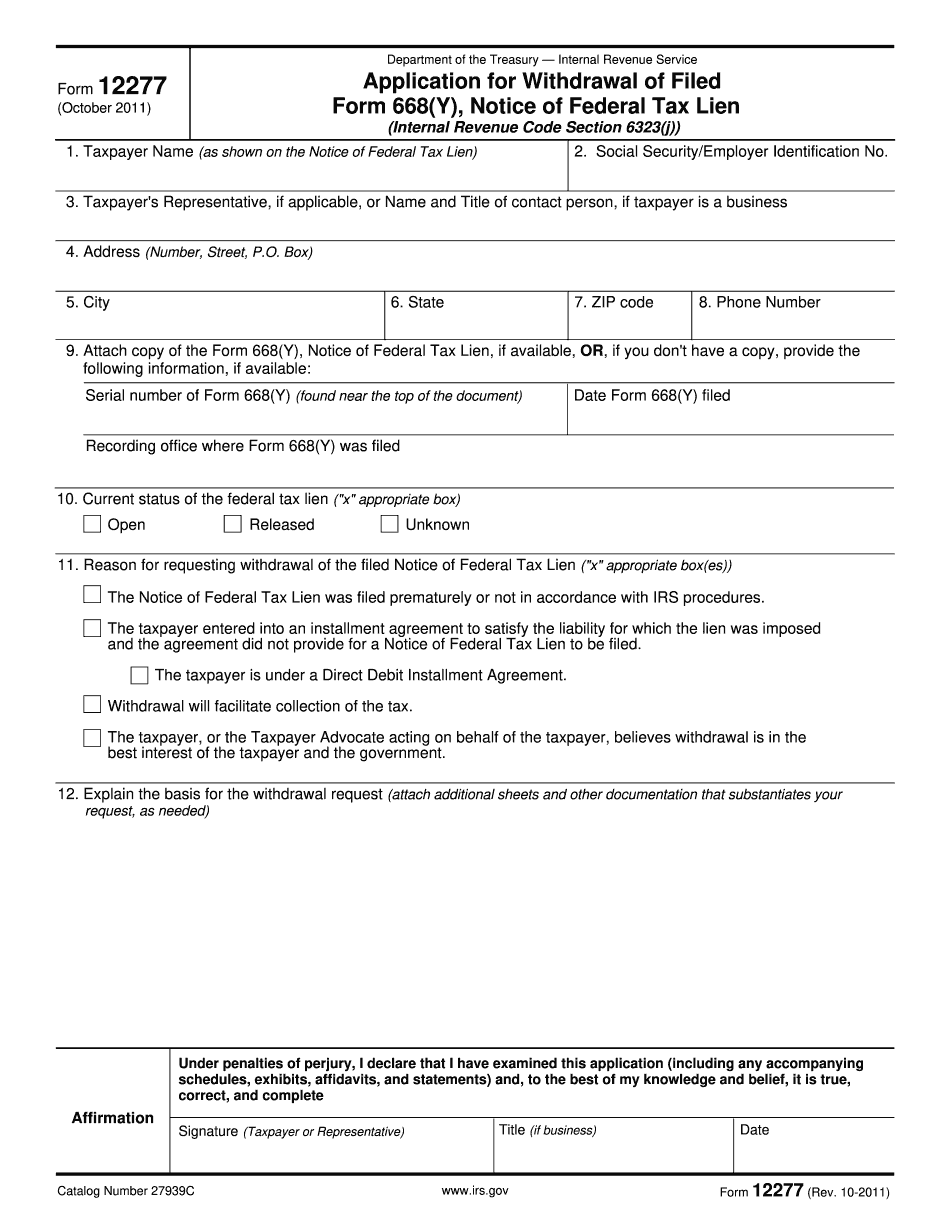

Form 12277 Houston Texas: What You Should Know

Doing this means they will no longer be entitled to collect taxes on your property, nor will they be entitled to collect your bank account information for past due amounts. In the past, the IRS often has responded to homeowners concerned with tax liens by directing them to fill out and submit a form for a petition to remove or “clean slate” their tax lien. This form has two parts. In Part 1, you answer a series of questions that should help you answer whether you or your spouse should be the subject of a federal tax lien. As I noted, this is a fairly simple process, but it is worth your time to understand and follow. Then, depending on who you are, you're either advised to submit the form to the agency, or if you agree with this decision, you are also advised to complete Part 2. Part 2 is what the IRS really wants you to do. They want you to apply for a notice of withdrawal, which is a form of bankruptcy (essentially a tax lien that's not actually an actual lien). This notice allows the IRS to issue it back to you in full and on your terms. This is much more convenient than taking them to court, where a trial may be necessary if you find the IRS has done something wrong. The IRS does not have to notify you that your petition has been denied, for example, because it has determined that your property is exempt from tax. All you have to do to get the lien removed or wiped away from your property is submitted the form. If you don't submit the form to the IRS within 30 days of receiving it, you can take it to a district court for a bench trial. There are only three reasons for submitting the form to the IRS: To prove ownership to you or to a third party of the property. To provide a statement of what the property is worth. To remove the lien on the property to a third party. Part 1 — Why it's important The IRS does not want anything that might help you with your tax problems. We can make a good case that you should want nothing at all. That's because a tax lien can ruin your credit rating. (It doesn't hurt your credit, but it certainly hurts your ability to pay your federal income tax when you get paid.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 12277 Houston Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 12277 Houston Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 12277 Houston Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 12277 Houston Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.