Award-winning PDF software

Form 12277 Huntington Beach California: What You Should Know

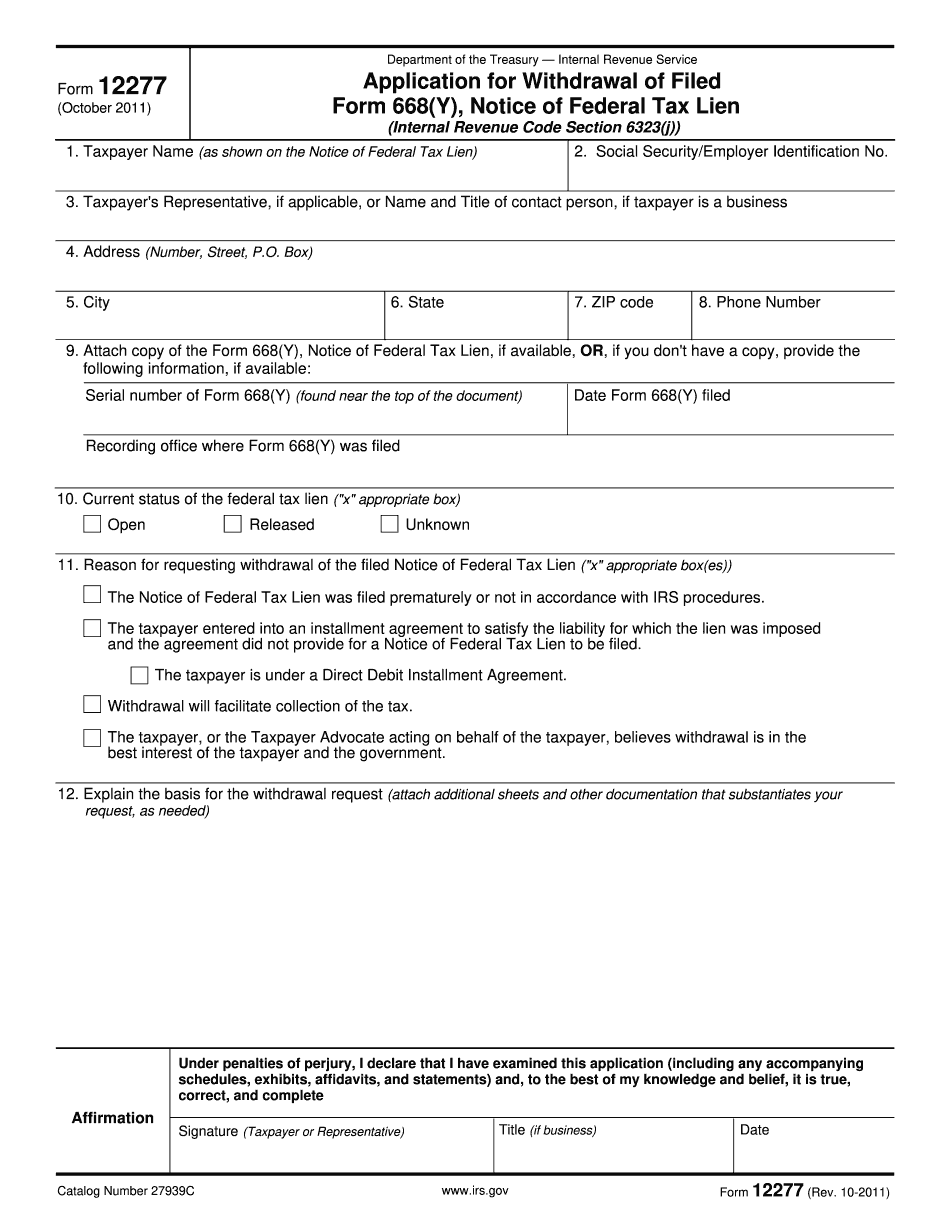

There are two legitimate purposes for this notice: To identify a delinquent taxpayer to collect the taxpayer's delinquent Federal tax payments (tax liens are used to collect tax from delinquent taxpayers). To provide a notice of a pending tax payment that has been filed by taxpayers who are currently delinquent in federal taxes, while the taxpayer's balance is not yet cleared. (tax liens are used to collect the unpaid amount of taxes.) Tax liens for federal tax debts are not released until a tax bill is paid through the correct tax bureau. Therefore, if there is a debt that is delinquent in the court that issues the tax bill or if a notice of failure to pay has been posted as a civil tax lien, notice of Federal tax lien is not issued until after a balance is cleared. The IRS does not issue tax liens for state or local tax debts. State and local tax debt collection agents deal with these debts on a case by case basis. Tax liens have no bearing on property claims. Tax liens are only associated with debt payments. A tax lien may be issued for any unpaid amount of a tax debt that has not been paid within 120 days of the tax return that is the subject of the Notice of Filing. Please contact me by email before you send, for more information on Form 12277. If the filing authority to whom a federal tax lien has been issued has not yet recovered the tax debt. If there is a claim for a property interest or other monetary judgment on property that was subject to the tax lien before the lien was properly issued, and that judgment has not been satisfied, the lien and the lien holder should be filed with the appropriate county of the county where the property is located. We do not send out forms to taxpayers. You can visit the following websites: U.S. Department of Justice This is a site designed to help you find out how to handle some situations where the government is claiming property in your name or on your behalf, including cases in which someone is being sued for a wrongful termination of property. This is a site designed to help you find out how to handle some situations where the government is claiming property in your name or on your behalf, including cases in which someone is being sued for a wrongful termination of property.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 12277 Huntington Beach California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 12277 Huntington Beach California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 12277 Huntington Beach California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 12277 Huntington Beach California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.