Award-winning PDF software

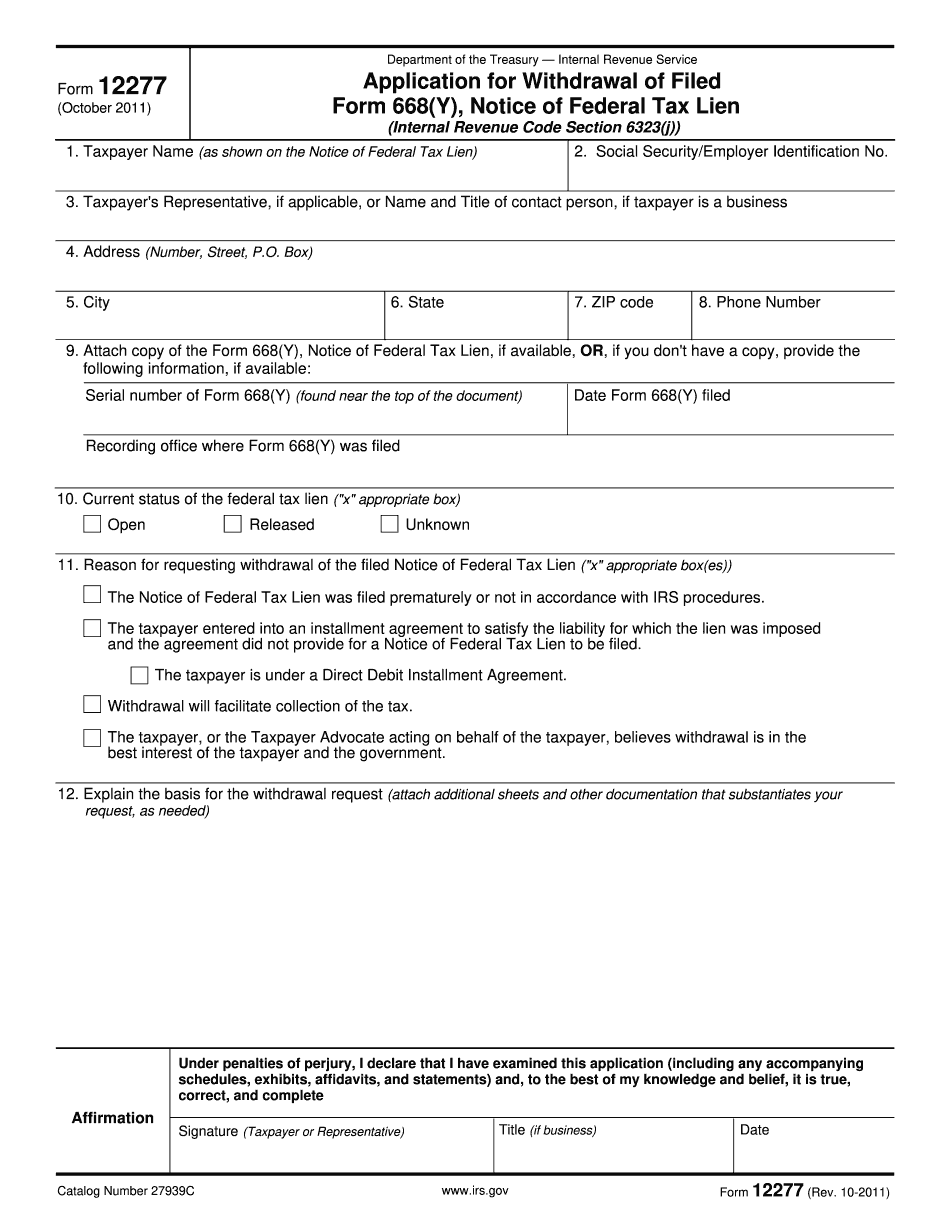

Form 12277 online Elk Grove California: What You Should Know

On the other hand, if the account does not show a payment history, then you should complete the form and submit your receipt to the IRS with the information required on that form. In other words, you should pay the IRS 0.00. — Avvo.com Form TIN-F-1114 is required on the back of the form to identify yourself, your address and your taxpayer identification number (TIN). A tax lien is a legal claim by a party with authority to collect the amount of money due that it has not collected and is not in the possession of the tax agency. A tax lien can take various forms including interest and penalty from the amount due and additional money from the claimant or other third parties. In most cases, the tax lien arises from an error on the tax agency's part. A tax lien filed by the taxpayer can be enforced and the amount claimed by the taxpayer must be paid and not be satisfied by the tax agency until payment is received. The Internal Revenue Service can enforce a tax lien in a variety of ways. A tax lien is often filed by the bank or company the taxpayer owes money to, if that company has its own collection agency. If the taxpayer fails to respond and files a tax lien, the IRS can take the lien for itself by filing an action in the United States Tax Court. Alternatively, the IRS can levy collection on a tax lien, and that action is known as an “extraordinary collection,” a so-called “bail-in.” Extraordinary collection means that the IRS needs to raise more money in the liquid bond market, usually by raising more money by raising auction prices of its existing bonds. On the other hand, an extraordinary collection might result from a bankruptcy. When filing a tax return, the IRS also must file Form 1040X, Miscellaneous U.S. Information Returns. It is the obligation of the taxpayer to report every income and every expense he or she receives and pays. However, if the taxpayer files a tax lien against a claim from a third party, the taxpayer is obligated to pay taxes on the debtor's claim, not the lien.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 12277 online Elk Grove California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 12277 online Elk Grove California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 12277 online Elk Grove California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 12277 online Elk Grove California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.