Award-winning PDF software

Jacksonville Florida Form 12277: What You Should Know

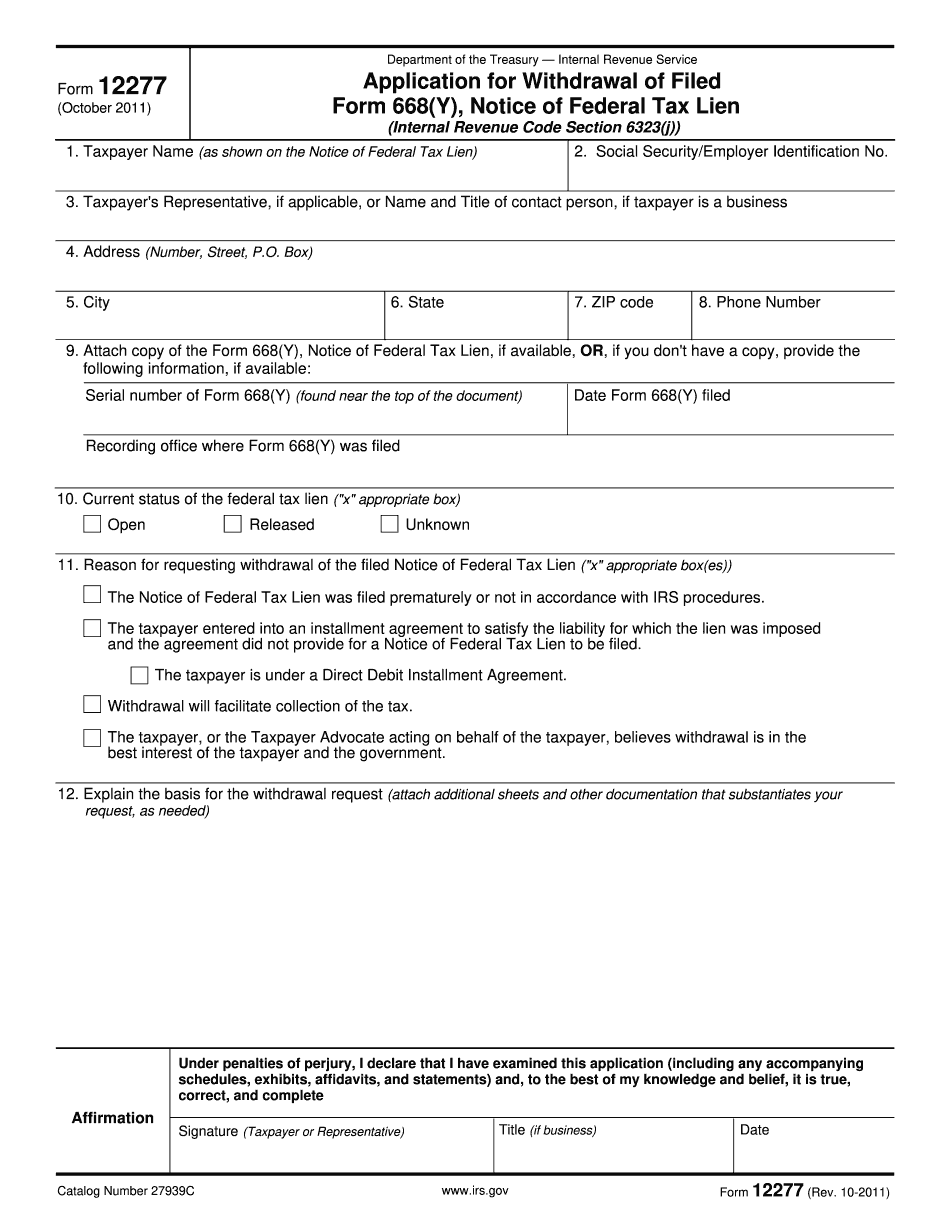

This form has to be filed to complete the process to disallow a notice of tax lien. Form 12277 may only be used by a sole proprietorship or partnership and an employee or owner that does not qualify as a shareholder or officer, or that does not qualify as an officer from the same entity. Other types of taxpayers cannot use the IRS Form 12277. The IRS Form 12277 is available on our Forms page as a PDF that allows you to modify the document and save it. The document is very straightforward and does the job very well! We strongly encourage owners to modify their templates to get the most accurate document that suits your company and needs. The modifications can be made on your web page with no need for faxing. The modification process takes only five minutes, and is well worth the effort! Once the entire modification process is completed it will show up on every tax return it is completed on. If you are a sole proprietor or manager, you should make this form a part of the Form 278 Process. Once the original version has been filed, it is a great idea to print the corrected copy in case of further changes. This is especially helpful if the notice of tax lien has moved from city to city. Just modify the document as desired and have it faxed to your office or your city clerk. This way if the notice moves back to an old city, the IRS Form 12277 will be automatically changed to reflect the new location of the tax lien. If you are an officer of a limited liability company from one town to another, you could also file a modified version of Form 12277. This would involve printing the original (modified), faxing it to the city clerk, and then going out and signing it. If you are an LLC from one town to another, modify the notice of tax lien to reflect the new name of the entity. The entity will also have to be filed. Here is how to do that if the notice of tax lien has now changed from one town to another. In this case, it should be the same as the original notice of tax lien. Here is an excellent video that covers the process step by step and even provides a detailed step by step how to print and modify an IRS Form 12277. The entire process has been covered in detail but be sure to watch the segment on the IRS website from the time of the video until you have an exact copy ready to fax.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Jacksonville Florida Form 12277, keep away from glitches and furnish it inside a timely method:

How to complete a Jacksonville Florida Form 12277?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Jacksonville Florida Form 12277 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Jacksonville Florida Form 12277 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.