Award-winning PDF software

Lakeland Florida Form 12277: What You Should Know

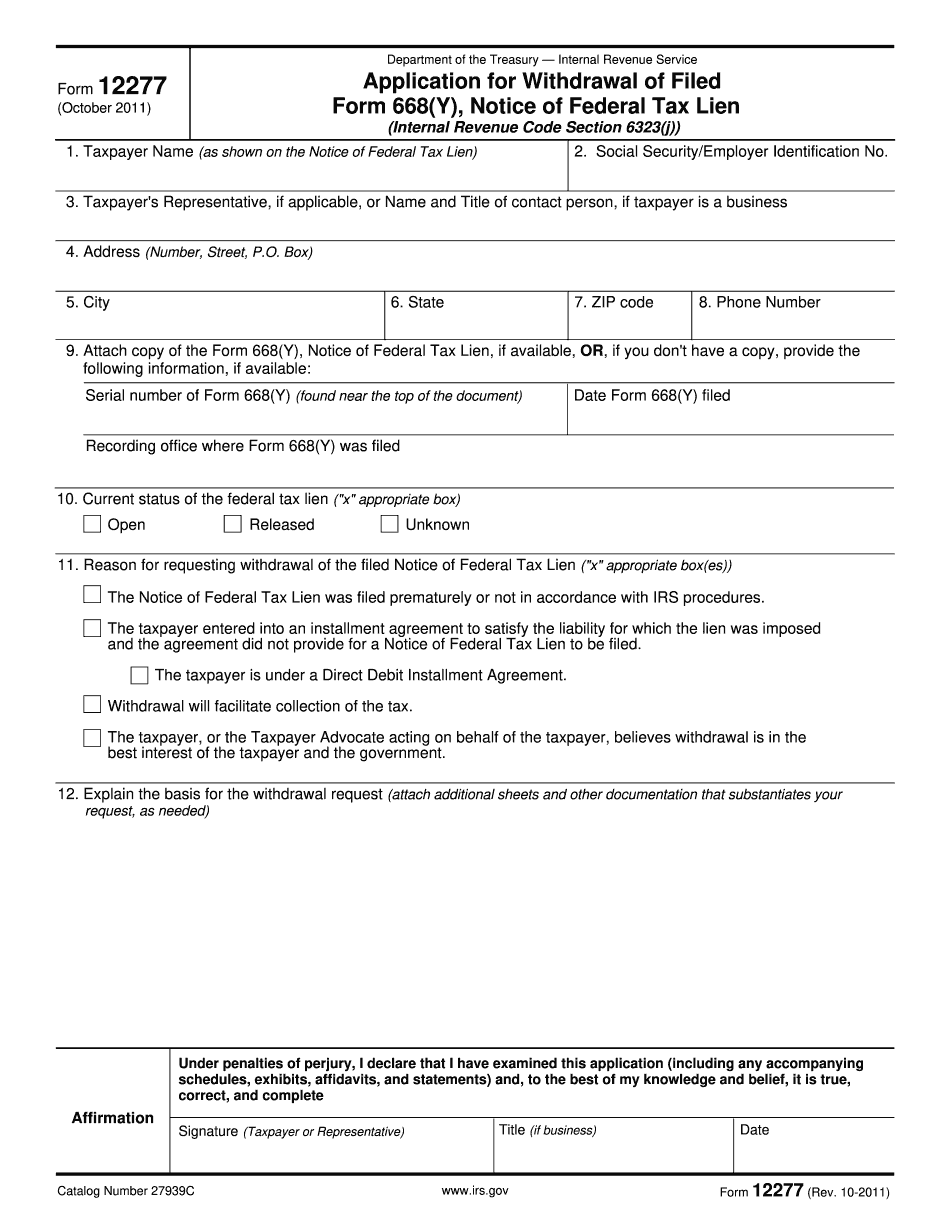

Withdrawal of Federal Tax lien. You may want to think about your situation before even seeking this type of action. Some of the issues you need to be aware of include your income and your debt. There are times when you should not try to “fix” your credit. A good way to minimize the damage is to work with the IRS to minimize the amount of time you will be under a tax lien. You don't see this happen very often because the IRS, or the creditor, will just move forward with the process and try to collect as much as possible and your ability to resolve the issue will be limited. In order to be eligible for a federal tax lien withdrawal, all you should have to do is provide us with your: Your name and address. Your SSN. Your Social Security number. The number of the bank account that holds assets that are subject to a federal tax lien. The IRS also makes it easier for you by requiring that you provide us with all of your information when completing IRS Form 668(Y). Once you use these instructions you will have the opportunity to complete additional fields in the IRS Form 668(Y). You may also be eligible for the federal tax lien withdrawal even if you are not in default with the IRS. If you believe that you are eligible for a tax lien withdrawal and your information is correct, please return the completed and signed IRS Form 668(Y) to us by postal mail to: The Lakeland Police Department 621 North Main Street Lakeland, FL 34236 or fax your completed and signed IRS Form 668(Y) to : 818.822.4430 If you have questions or require additional information, please contact the Lakeland Police Department at for further assistance. This form must be completed within 14 days of the date of original lien to receive a tax lien withdrawal. If you do not need this form for a tax lien, then please complete and mail Form 4868(Y) instead.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Lakeland Florida Form 12277, keep away from glitches and furnish it inside a timely method:

How to complete a Lakeland Florida Form 12277?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Lakeland Florida Form 12277 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Lakeland Florida Form 12277 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.