Award-winning PDF software

League City Texas Form 12277: What You Should Know

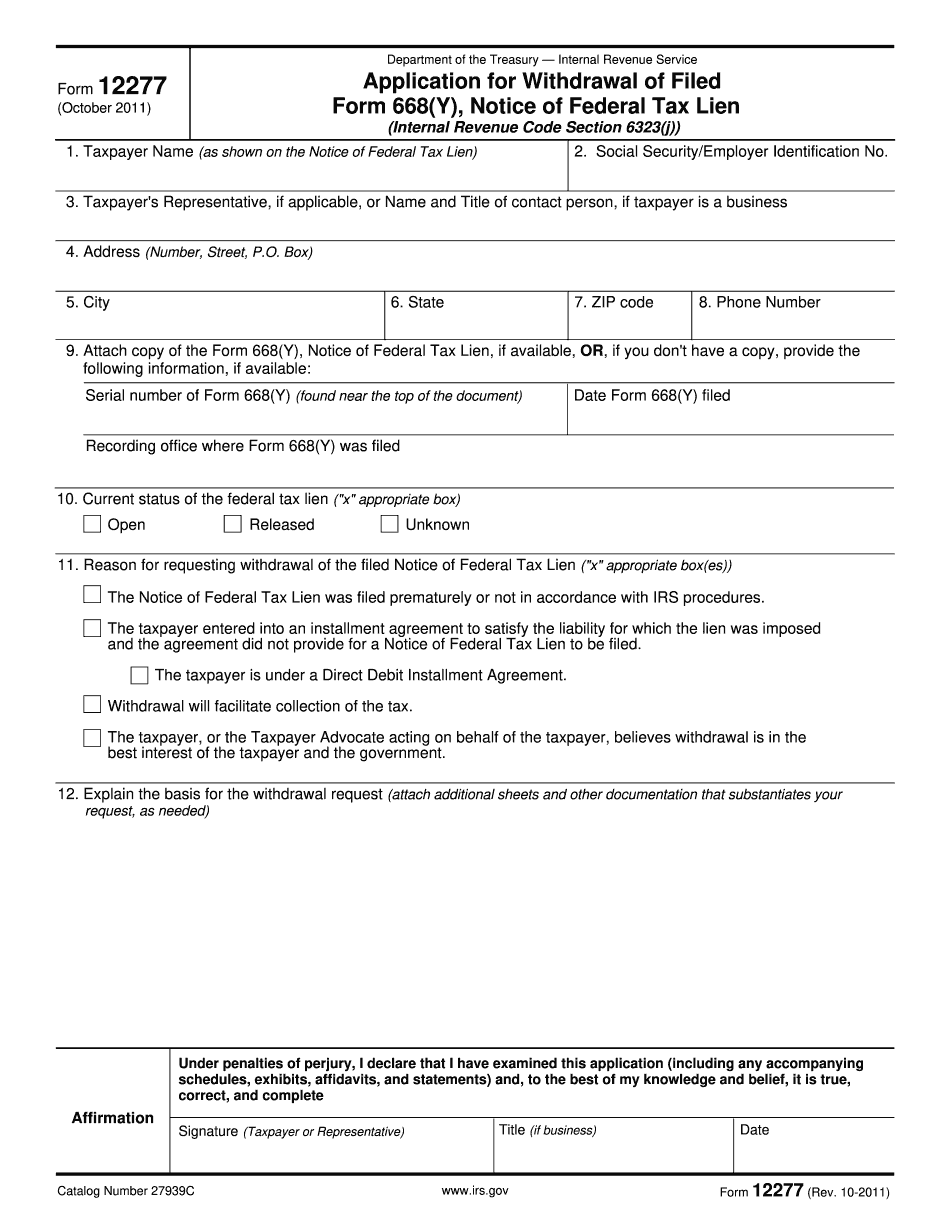

The following IRS guidance is relevant if you are having a tax lien filed on your record. If you need help, contact E-mail Support Team at SupportLEGS.com Taxpayers whose information is being used to file a federal tax lien have many options for making sure that the IRS does not consider them a potential credit or refund liability. These options include, but are not limited to: If you want to avoid the credit and/or refund penalty associated with the filing of a tax lien, you can choose to file on IRS Form 5329, Petition to Withdraw and Avoid a Federal Tax Lien, with the IRS (otherwise known as a Notice of Federal Tax Lien). Even if you are not seeking to avoid a federal tax lien, you may want to consider a Taxpayer Assistance Program (TAP) request (also referred to as a Notice of Federal Tax Lien) as a way to prevent further IRS review of your credit or refund history and to get it to where it needs to be for tax purposes. To be eligible for a TAP request, the requestor must: Be a victim of identity theft (either knowingly or negligently); Have been the victim of identity theft within the past 90 days; and Not have had the tax lien placed on their credit file. TAP requests generally take one to three months for processing. TAP requests are generally accepted during the period from February through October. Some jurisdictions may limit the duration of a TAP request, and in those cases, you should contact your local tax office for more information. To request TAP, a taxpayer, tax services division personnel or TAP staff in your jurisdiction can help you request a TAP. The information we're seeking on the form is below. If you qualify for and receive federal tax refunds, you are entitled to the benefits provided for in federal law. You can find out more about the laws your state has in place to make sure that you are not facing a penalty and interest if you owe the IRS a tax refund. If you have questions about these laws, you can call the Telephone Assistance Hotline at. If you think you might be a credit or refund liability, the IRS may need to determine your income and tax filing status.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete League City Texas Form 12277, keep away from glitches and furnish it inside a timely method:

How to complete a League City Texas Form 12277?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your League City Texas Form 12277 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your League City Texas Form 12277 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.