Award-winning PDF software

Meridian Idaho Form 12277: What You Should Know

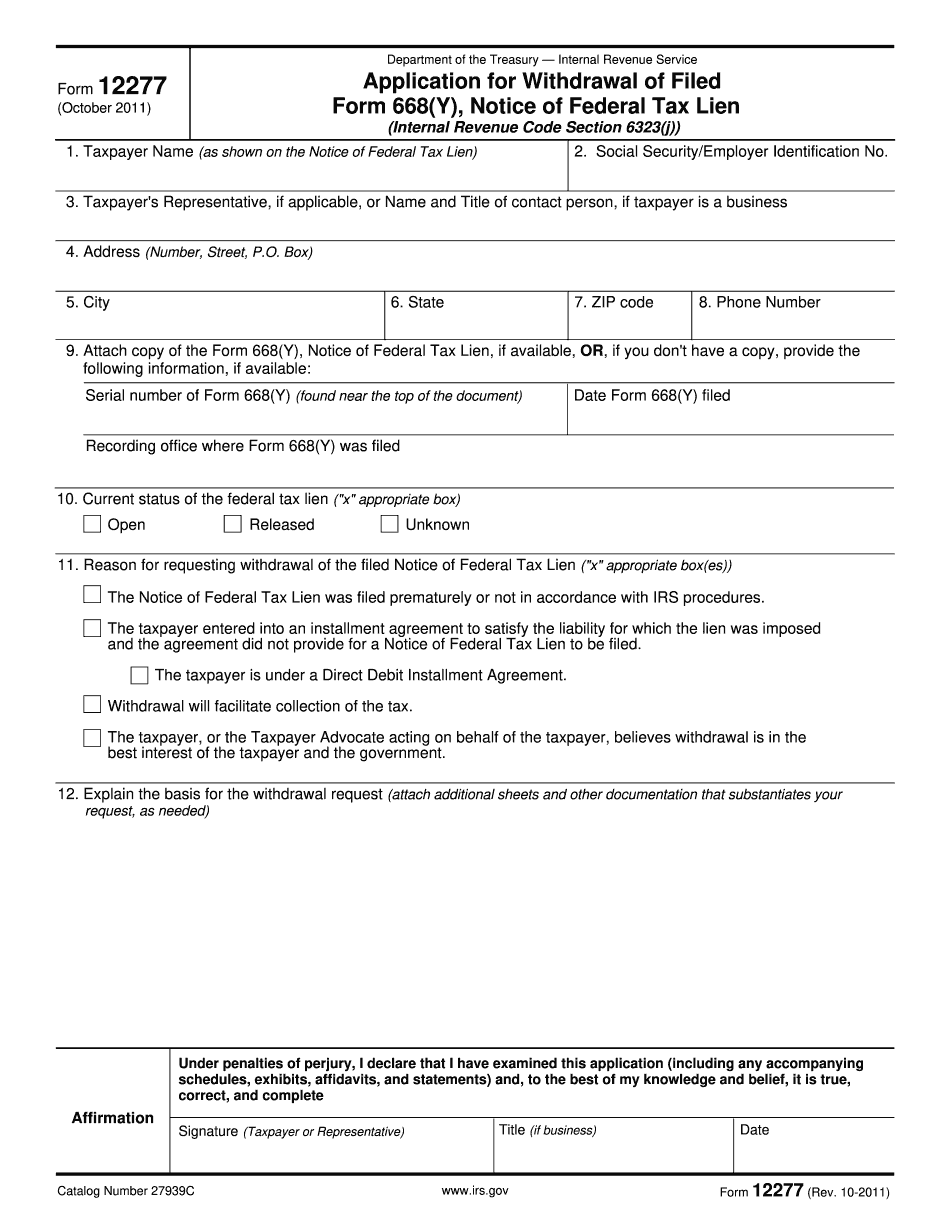

State. Please be aware that the deadline to file a notice of lien with the Dept. of Taxation (Idaho Department of Taxation) before a notice of lien is referred to the Secretary of State may occur within fifteen (15) days. For more information, please visit our website at: I am considering filing an Idaho notice of lien because I have had tax liens paid, but I do not have a state tax lien that would be removed before filing a notice. How would I file an Idaho notice of lien? If you are considering filing a notice of liens, you may do so as a result of a change in ownership, or a change in the location of the property, which would prevent the debt from being included in your Federal tax account. In that case, you'd file your notice as a federal notice of lien only, and not attach the Idaho lien. If you received a notice of lien from a court or a sheriff, please contact us immediately to discuss your rights. What does the Notice of Liens do? The Notice of Liens serves as a notice to all persons liable to pay tax, both persons who have filed their tax returns or notices of tax, and all persons identified on the Idaho Department of Taxation's (DOT's) list of persons who remain liable for tax and may be liable for interest, penalties, and/or interest-free payment, or payment in full, at any date, on any amount of unpaid tax. Note that only persons who have filed a return (or paid an IRS notice) are not liable for any interest or penalty. The Idaho notice of liens does not give you the right to dispute the lien, and does not give a right to an examination of the underlying taxes. Please visit our website at: for further information. Why might I want to have a Notice of Liens filed against me? You may want to collect your tax debt with an Idaho notice of liens, if you live in Idaho that is, because that State is the only State in the United States where you may have to pay your Idaho income taxes.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Meridian Idaho Form 12277, keep away from glitches and furnish it inside a timely method:

How to complete a Meridian Idaho Form 12277?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Meridian Idaho Form 12277 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Meridian Idaho Form 12277 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.