Award-winning PDF software

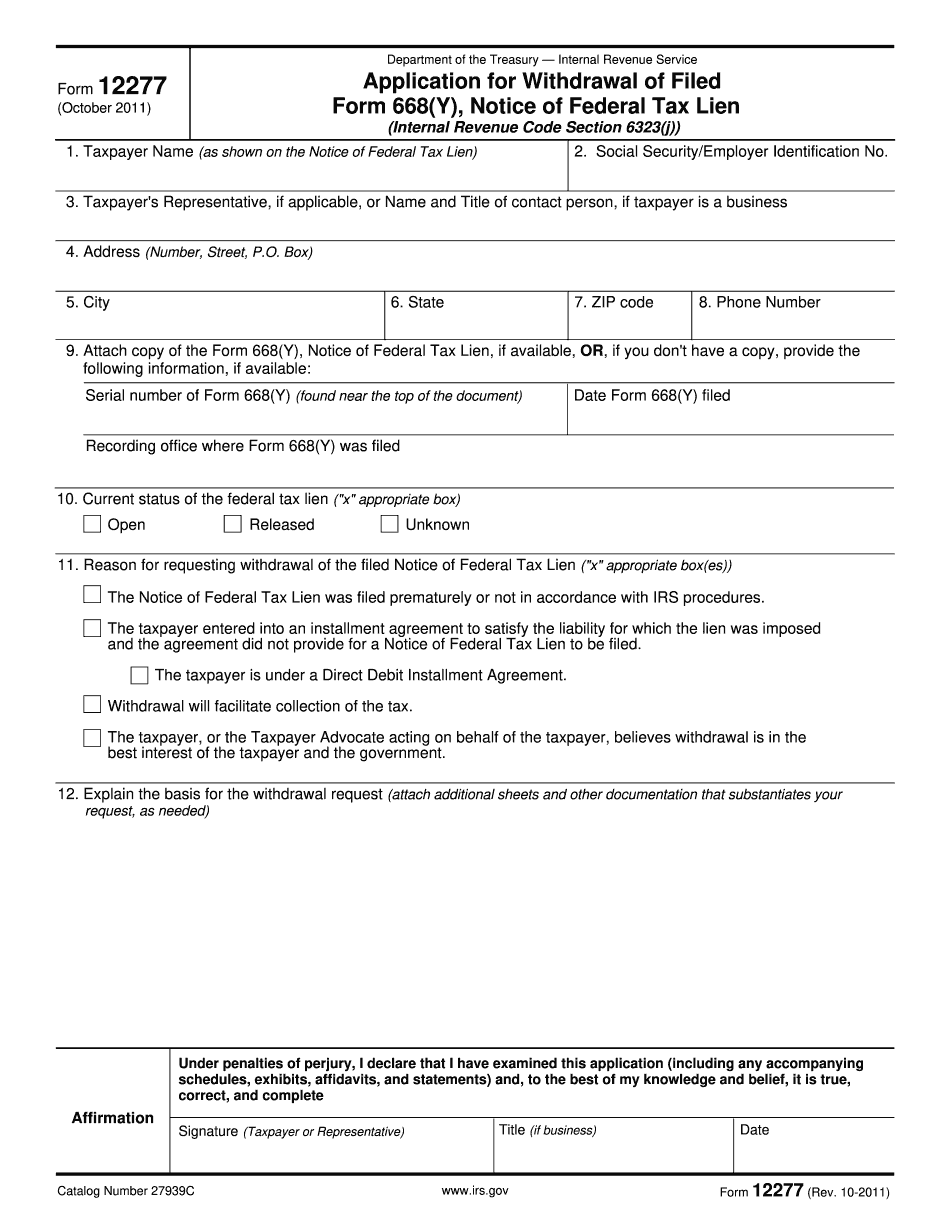

Printable Form 12277 Hillsboro Oregon: What You Should Know

Form 2011. Add a tax year, pay the estimated tax, apply any tax due. Fill in any extra information. 2010 IRS Form Create a blank & editable Form 2025 online. Apply the estimated tax by the due date. Apply the penalty or interest. Pay the estimated tax and any penalties or interest. 2011 IRS Form Create a blank & editable Form 2025 online. Make any desired changes to the form. Complete a check/money order for your tax lien payment. Send the payment for the tax notice. E-zine Form 1149, Filer's Affidavit, is used by taxpayers to establish the amount of any tax owed and to collect payment from the taxpayer. Form 1149 also assists with the collection of delinquent tax and penalties owed. It's available online or to taxpayers in person. Form 5320-EZ, Application to Withdraw Federal Tax Liens and Suspend Due Process Provides the taxpayer with a method for transferring a Federal tax lien to a State or Foreign State, which must then cancel the lien. A taxpayer's Federal Tax Lien must be canceled with one of the following: (e) Suspension of Notice of Federal Tax Lien: Any outstanding Federal tax lien, (f) Dissolution of Federal Tax Lien: For Federal tax liens with a remaining outstanding balance of 200 or less, or for Federal tax liens with a remaining outstanding balance of more than 200 but less than 5,000, the IRS may approve the transfer of the lien to a State or Foreign State if the State complies with this rule. Form 5320-EZ: Application to Suspend Due Process Provides the taxpayer with a method to suspend, for a period of not less than fifteen days, the enforcement of any Federal tax lien which was filed more than twelve months prior to the date the application is filed if the taxpayer submits a written notice of the objection within 90 days of the date the taxpayer filed the petition for recovery of the lien on the form. IRS Form 540C, Payment Receipt, is used when a taxpayer receives a refund from the Internal Revenue Service. Use and Use Tax Report The Use and Use Tax Report provides information on the Federal, State, and local use tax.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 12277 Hillsboro Oregon, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 12277 Hillsboro Oregon?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 12277 Hillsboro Oregon aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 12277 Hillsboro Oregon from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.