Award-winning PDF software

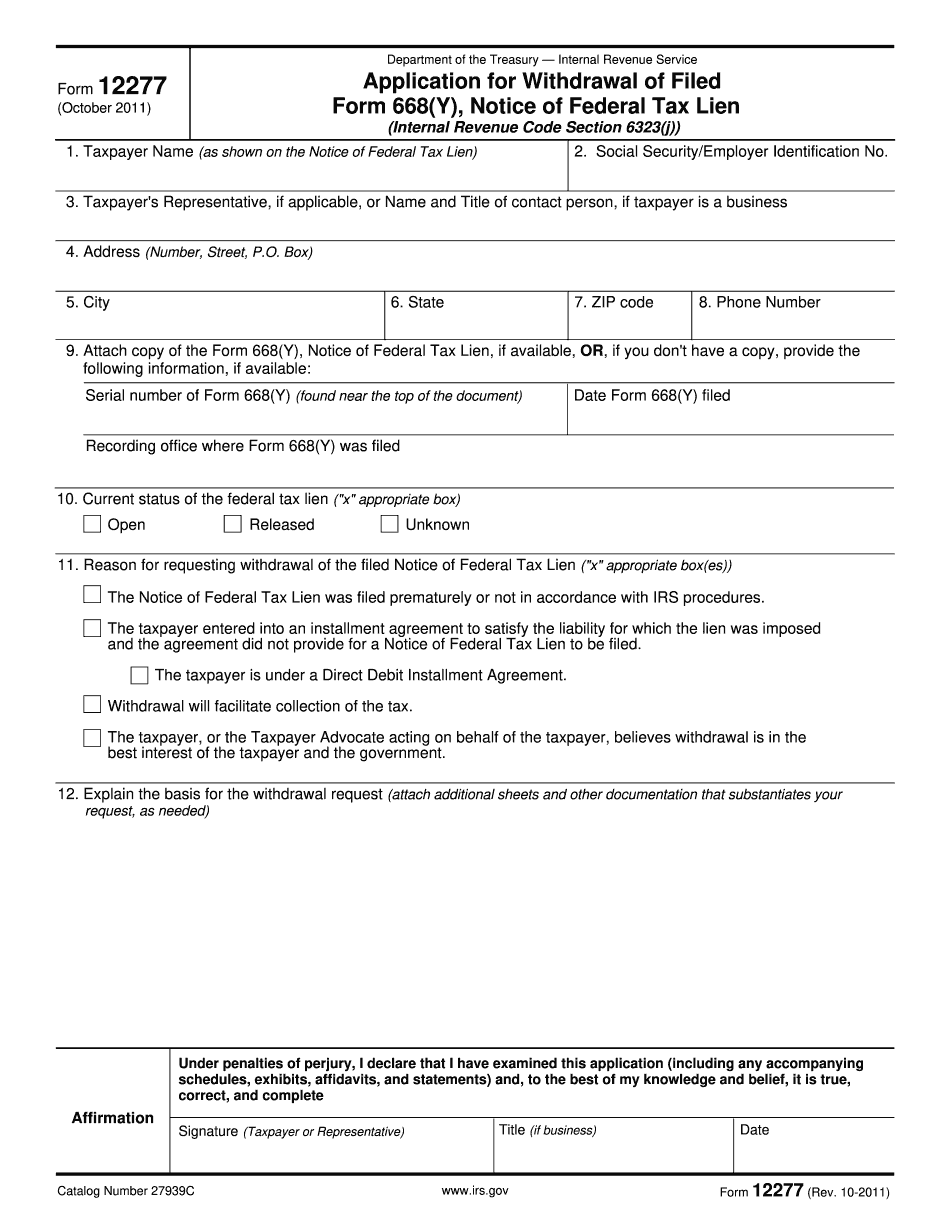

West Palm Beach Florida Form 12277: What You Should Know

GL Homes are a national, family-owned, fully-furnished, state-of-the-art construction company. Our company has worked on numerous projects in Palm Beach County over the last few decades. Our purpose for doing an extension is to allow us the opportunity to make further improvements in and around Indian Trails Grove. We'll be offering a variety of products for our customers at affordable pricing to provide an excellent home for a family of three or more, a home that is convenient to Indian Trails, and a more upscale and unique experience. We're also offering a special 999 cash down financing option to a group of qualified buyers that do not have a previous purchase. You can contact us at if you have any questions about this offer. We look forward to hearing from you. This is the form you used to pay the tax bill from the previous year. We only ask for your income for the year you file. You don't have to pay a tax bill on the current year's income if that income falls under certain income limits. In 2018, we'll pay 1710 (1,744 .08 × 34,000), we will not be paying a 744 tax bill if you paid 1214 (1710 × 8). If you aren't sure what limits to pay, you can check out this form. You can pay by check, money order or certified check. We will not remit cash. Once you complete the form you will be given a Tax Certificate Number, this will be your permanent tax number. Also, you need to bring two forms of identification with you to pay your tax: a copy of your tax return and a copy of your tax certificate. If you don't have any one of these, we can provide these forms. You can also pay by checking or money order. We will not remit cash. All payments must be received by tax office no later than November 15 for the following year. We do not take cash. You must send all payment in the form of: check, money order, certified check. The last payment paid in 2025 did not get to tax office until December 23rd. This form requires a minimum tax liability of 1 million and a maximum tax liability of 3 million for a married couple filing jointly. If your tax liability is below 1 million you must complete Schedule B-2.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete West Palm Beach Florida Form 12277, keep away from glitches and furnish it inside a timely method:

How to complete a West Palm Beach Florida Form 12277?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your West Palm Beach Florida Form 12277 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your West Palm Beach Florida Form 12277 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.