Award-winning PDF software

Form 12277 California Alameda: What You Should Know

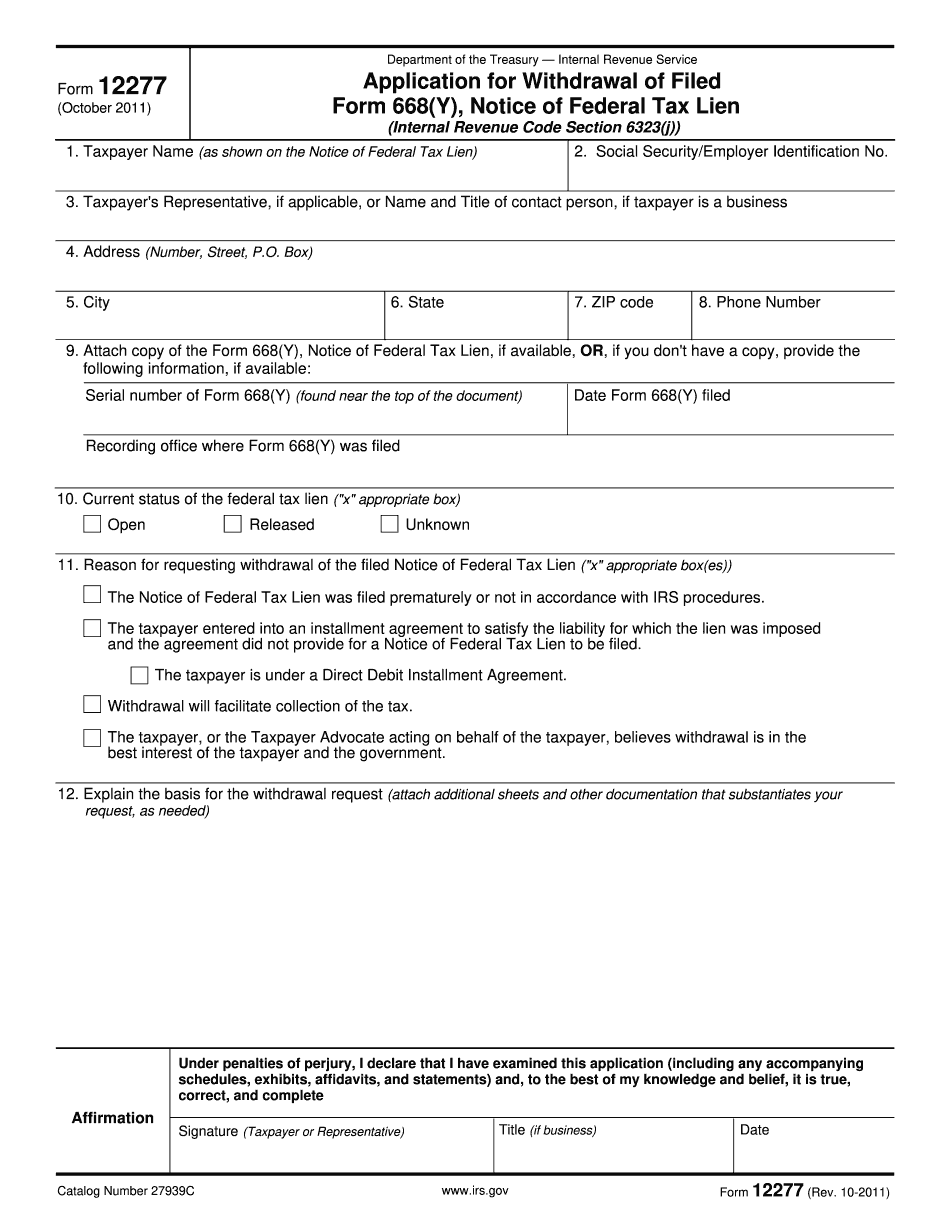

In most cases, this is true, but you have two options when it comes to creditors. Release the Liens : If you decide to release the property lien yourself, you must provide a complete and accurate filing date. You can also provide a statement of credit balance or current loan amounts for each item in the lien. This will help the creditor's attorney understand the value of the property and determine if it can be sold. Do it on your own: The second option is to use the release form. It only has a limited role: it merely allows creditors to see if you ever filed an application to remove the tax lien before, and the only information they would have to know is: · If you filed an application. · The name(s) of the person(s) filing. · The name of the tax lien. If the lien remains in effect, the lien will attach. The purpose of filing form 1872 is to get the IRS to release the tax lien. The purpose of Form 1872 is to avoid and/or reduce the collection and administration costs of the lien. If you agree with the value of the property, the process is pretty straightforward: Fill out Form 1872 (or Form 12277 or other appropriate form) and mail it to: C.B. & B. Mortgage Bank of Southern California P.N. 511 S. La Mesa Street, Suite C-300, San Diego, CA 92107 The creditor you receive the lien from will mail you a check for the lien amount along with instructions on where to pick up the check. After paying your installment, the lien should be removed from your credit report, and you will avoid the high transaction fees to the creditor.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 12277 California Alameda, keep away from glitches and furnish it inside a timely method:

How to complete a Form 12277 California Alameda?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 12277 California Alameda aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 12277 California Alameda from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.