Award-winning PDF software

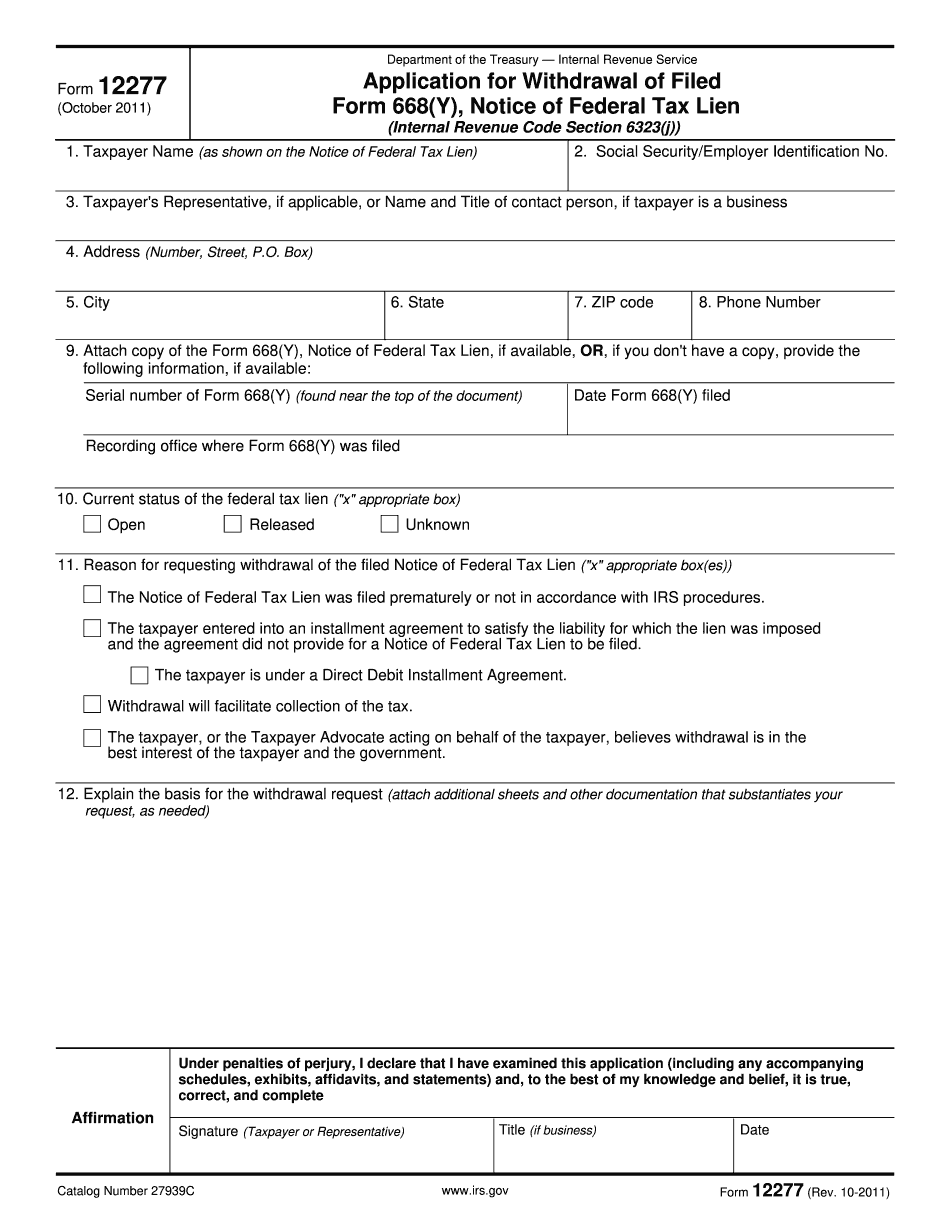

Printable Form 12277 Clark Nevada: What You Should Know

Local Building Commission of Clark County, an Unpaid Property Taxes lien recorded by the County and a Recordable Tax Debt lien registered with the Real Property Transfer Tax Agency of Clark County. If you believe that you are a liable party in a tax lien, you can file a request with the Real Property Transfer Tax to record the lien. The application to withdraw a lien includes information to: Record a lien Enter information on the Form Petition for Recording/Withdrawal1 To file: To request recording of a lien: Fill in and return all the required information on the request form. Download the “Record Request Form,” which must be completed to apply for recording of a tax lien. Record a lien must be included on the form, and they must be filled out before recording the liens is initiated by the owner or tenant. If you are not liable, you must do no more than enter the required information on the form. This is an absolute and complete withdrawal of the liability of the property owner or tenant upon expiration of any lien. To request recording of a tax lien: The owner or tenant must do no more than enter the required information on the form. This is an absolute and complete withdrawal of the liability of the property owner or tenant upon expiration of any lien. Note: For more information on tax liens see Tax liens: Tax liens may be the most common type of tax liens. A property owner or tenant can file a lien against real property to collect past-due taxes or other claims from the owner and landlord. A lien is a claim by a creditor against the property of a debtor in order to gain possession, possession, or control of the property. The lien can also be an eviction. The debt must be legally enforceable by the lender. The form is a record of a judgment against the debtor in a court. As a result, a lien is a separate entity from the debt. If the debtor has not been sued or otherwise in process of collection against the debtor, the lien is a “default judgment” — a judgment for the amount due for a payment due. If payment is made within a period of time the judgment will be reduced or nullified, depending upon the debtor's ability to pay due to the “default” of the debt.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 12277 Clark Nevada, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 12277 Clark Nevada?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 12277 Clark Nevada aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 12277 Clark Nevada from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.