Award-winning PDF software

Form 12277 online Kentucky: What You Should Know

The lien notice should be kept for your records only, and should be destroyed when the period ends. When can the IRS come after you? The IRS does not pursue debtors before they have appeared in court, except in certain very limited circumstances. If an IRS Notice of Federal Tax Lien is filed against you in federal court, you are no longer liable for the IRS debt. In that case, you would not be liable for a second or third installment of the tax. Even if the creditor has filed its notice of judgment against you, the judgment is not enforceable against you, and you will not be required to appear in court to defend yourself. In addition, if you are found in violation of your installment agreement for repayment of the tax, the IRS would likely not be able to collect a second or third collection installment. As explained above in the notice of intent to levy, if you have the judgment, even if you lose (and you should, be prepared!) on the initial levy, the creditor is still obligated to pursue collection of the tax, even if the judgment is later reversed in state court. This means if the judgment is overturned by the appellate court, the IRS cannot attempt to collect the tax through other collection methods. There are exceptions to the no-venue-of-court and no-collection provisions of the federal tax laws. However, if a judgment or a levy is not enforceable against you, it will not affect the amount of tax you owe, regardless of the state of the default. You can learn more about the federal tax lien statute in Internal Revenue Bulletin 2011-12, Volume 49, Issue 6 (May 2011). To find out if you are under scrutiny for taxes due, go here. You Can Have Your Tax Lien Credited to a Third Party If, within 7 years of the Tax Liens being issued by the IRS, the third party files a Notice of Federal Tax Lien in your name without first obtaining a court order based on state law, the third party's lien will appear as judgment against you. You will be required to pay the judgment if the Notice of Federal Tax Lien is not revoked. If you are a third party and a Notice of Federal Tax Lien is issued against you, you can file a Notice of Federal Tax Lien with a law enforcement officer. You will still have to pay the judgment if the Notice of Federal Tax Lien is not revoked.

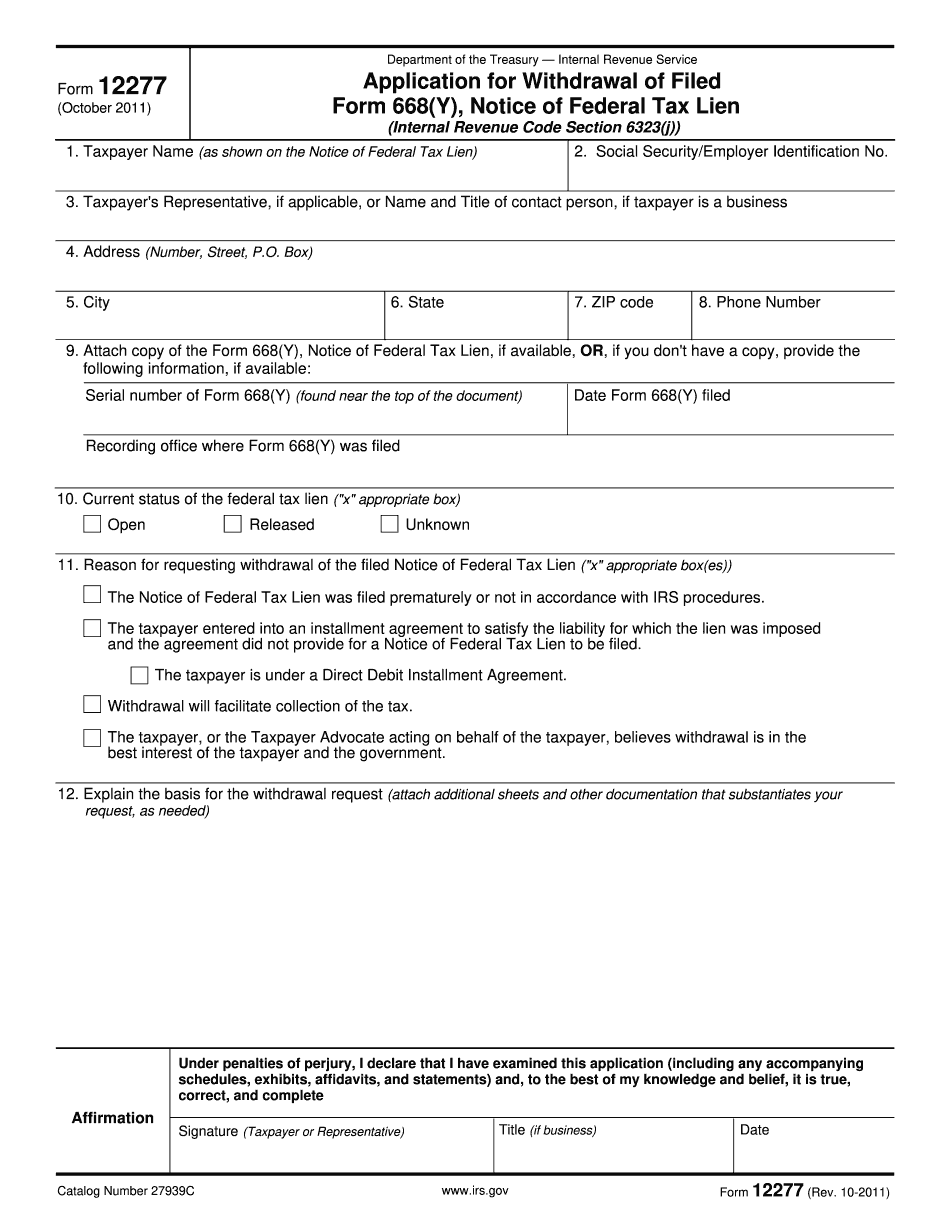

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 12277 online Kentucky, keep away from glitches and furnish it inside a timely method:

How to complete a Form 12277 online Kentucky?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 12277 online Kentucky aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 12277 online Kentucky from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.