Award-winning PDF software

Form 12277 for Evansville Indiana: What You Should Know

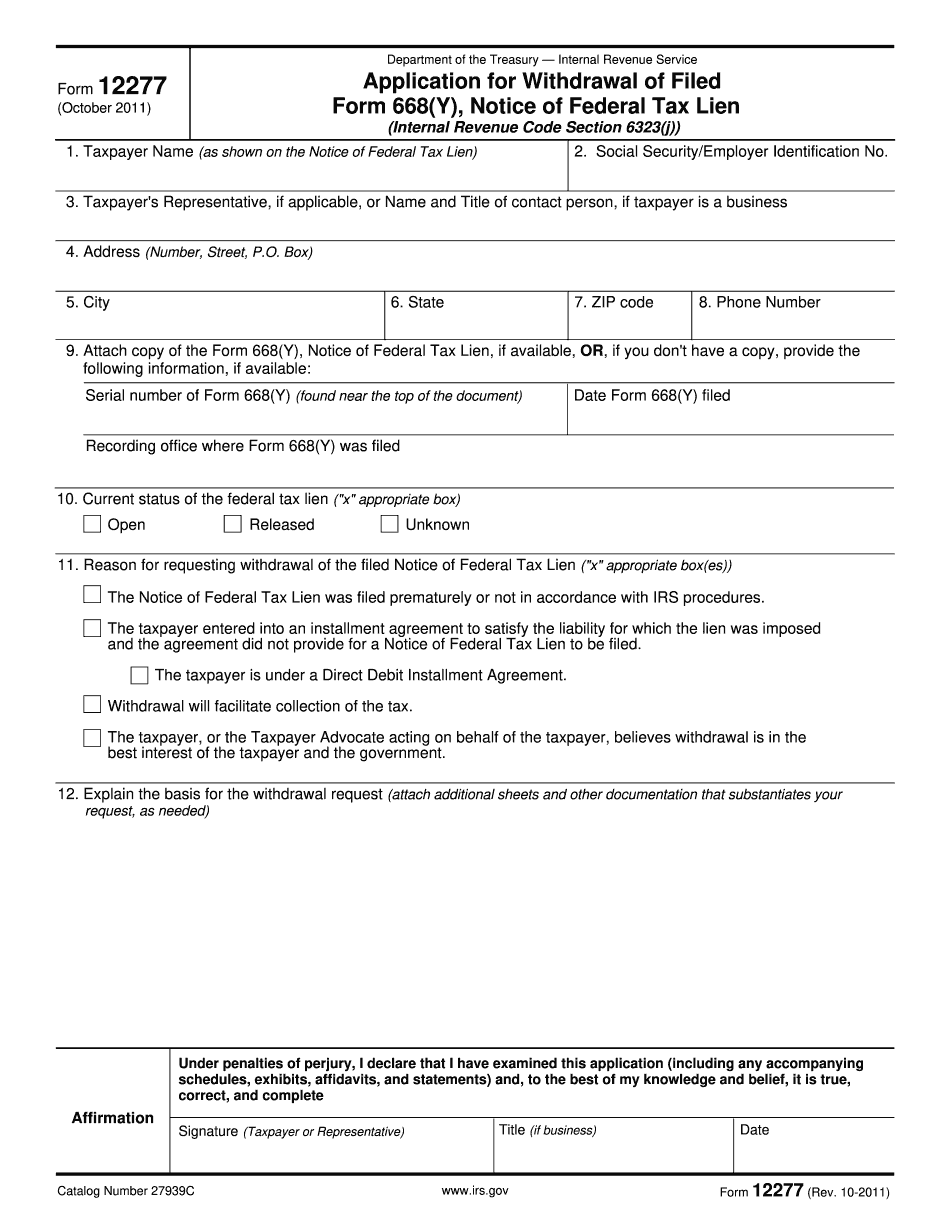

Form. The following forms do not apply to homes or real property. They only apply to financial institutions, business corporations, and other organizations. The claim forms above are not required by the IRS, nor does an IRS form in and of itself mean that an entire tax liability is removed. This is because the IRS has the discretion to deny and/or withdraw the form request if it determines that the form is frivolous, made in bad faith, or is submitted more than once. But if the claim is determined to have merit by the IRS, then a full refund will be issued to the taxpayer. You must send your written request with all supporting documentation to: Mail: US Department of Treasury Mail Stop: WqA-10, Taxpayer Services Center 400 Maryland Ave., SW Room 1409 Washington, DC 20001 Informal Request for Withdrawal of a Federal Tax Lien for Property Liable to the United States Receipt by mail to: Citizen Services PO Box 812 Washington, DC 20015 To review the information in the form, you may download and fill out the form. If you don't have a computer or printer, you may mail a photocopy of the form. After you have completed the form, you must provide the following information by mail to the address above: Vandenberg County (Receipt by mail) Citizen Services Vandenberg Federal Building 700 North Main St Vandersonton, IN P.O. Box 5 Muncie, IN 46308 US Address and Telephone Number: If you do not have a US address, you can still complete the Request For Withdrawal of a Federal Tax Lien and submit it by mail to the address above. You may also want to visit the IRS.gov website and look up federal tax liens on IRS Form 4868, Request for Withdrawal of a Federal Tax Lien. Tax Liens for Property Liable to the United States If you have a federal tax lien that the federal government has collected tax on, you may want to check out some information listed below. If you don't see a particular type of property on the list below, it doesn't mean that that IRS lien is not valid. It just means that we do not have a record of your property being assessed in and is not liable to the federal government.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 12277 for Evansville Indiana, keep away from glitches and furnish it inside a timely method:

How to complete a Form 12277 for Evansville Indiana?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 12277 for Evansville Indiana aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 12277 for Evansville Indiana from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.